Harmonised regulations for European Crowdfunding Service Providers (ECSPR) apply to the entire European Union from November 10th, 2021, following a 12-month transition period.

One of the primary challenges in European crowdfunding was the lack of unified rules for digital lending and investing in businesses. The requirements were different in every member state. This prevented crowdfunding platforms from expanding and limited businesses to getting alternative financing only in the countries of their origin.

Now, crowdfunding platforms can apply to an EU passport that would allow them to offer their services across the whole European Union.

Existing operators have a one year transition period to comply with the new rules. Authorisation must be granted within 3 months from application.

What you will learn:

What are the major benefits of ECSPR?

The key benefit is the appearance of a single market for lending and investment-based crowdfunding and the protection of investors.

Even though many countries haven’t yet implemented the necessary rules in accordance with ECSPR, the most prominent benefits are quite clear:

- all platforms authorised under the European Crowdfunding Regulations will be collected in a public register;

- investment projects will need to disclose project details in a unified form;

- uniform rules on governance and risk management for crowdfunding platforms;

- transparent credit scores;

- mandatory warnings if the investor has insufficient knowledge or insufficient ability to bear loss associated with crowdfunding;

- 4-day cooling-off period within which investors can withdraw from their investment promise, etc.

Which platforms need to take action?

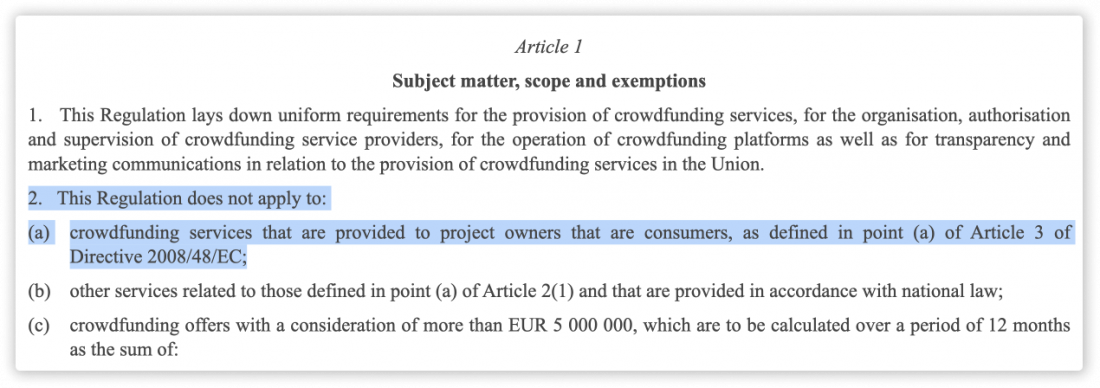

As per the Regulation of European Crowdfunding Service Providers published in October 2020, the new rules apply only to the companies that offer their services to non-consumers, that is lending-based and equity-based crowdfunding.

So it looks like the new Regulation does not apply to micro-credit and P2P consumer lending platforms that are regulated separately in every country.

Another way to avoid the new regulations is to get an Investment Brokerage Firm license (IBF). This strategy was used by the Latvian crowdfunding platforms Viainvest and Mintos who secured their licenses from the Financial and Capital Market Commission in Latvia.

With that said, European Securities and Markets Authority published a report on the proposed draft Regulatory Technical Standards that reflects feedback from 32 respondents who agreed to participate in the Consultation Paper.

The report covers investor protection aspects under the ECSPR, namely:

- complaints handling;

- conflict of interest;

- business continuity plan;

- authorisation;

- information on default rate;

- entry knowledge test and simulation of the ability to bear loss;

- key investment information sheet;

- cooperation between competent authorities;

- reporting;

- notification to ESMA of national provisions concerning marketing requirements;

- cooperation between competent authorities; and

- cooperation between competent authorities and ESMA.

Based on the feedback, the draft technical standards will be updated and submitted to the European Commission for adoption, the decision must be made within 3 months from the submission.

Main challenges and opportunities

According to Sebastian Vetter, Regional Head at Mangopay, the introduction of European Crowdfunding Regulations will change the market noticeably.

In his article at Startup Valley, Sebastian mentioned that the crowdfunding market has its unique features in many countries.

In France, for example, all types of businesses heavily rely on crowdfunding in addition to stocks, bonds and donations.

At the same time, crowdfunding in Spain is less developed as the national crowdfunding regulations are too strict and make the crowdfunding business difficult. Ramon Saltorn, a member of the Spanish Fintech and Insutech Association, says that the new regulation will enable crowdfunding platforms in Spain to create forms of investment that will allow the market to grow.

Alessandro Portolano, a partner at an Italian law firm, shared that unfortunately, Italy has not yet implemented all the required and much-needed legislation.

For example, we don’t know whether only one (extremely unlikely) or two (extremely likely) regulators will be in charge and how this two-prong system will specifically work. That means that if you want to apply for a license you currently will not know to which entity that shall be addressed, not exactly a minor detail.

He sees the current situation as a potential threat to Italian crowdfunding platforms, as foreign ECSPs, once they have obtained their license, will be able to activate their EU “passport” and access the Italian market.

At the moment, Italy has not yet officially assigned an authority that will be in charge of supervising crowdfunding operators.

Takeaway

While the Regulatory Technical Requirements still remain to get adopted by the European Commission, crowdfunding platforms have enough time until November 10, 2022, to adapt to the new legislation.

Even though the transition process is not going to be very smooth for all crowdfunding industry players, it’s definitely a start to a more developed alternative finance market, more educated investors and more businesses being able to push the economy forward with capital.