Financial companies and trading startups that explore new opportunities often don’t know how to choose the best trading platform because of the abundance of features they see and not necessarily require.

The staples of any trading platform are of course security, fees and commissions, client support, and platform functionality.

An FX broker security is determined by its compliance with regulations, fees are set according to the business model, and customer care should be professional by default.

But what about the platform functionality? Is there a compulsory toolkit every forex trading website design must have to attract more clients? And is there a recipe on how to make a trading system or app that will be a success?

Today we’re going to shed the light on forex trading website development and answer all these questions. Let’s go.

What you will learn:

How to make own online forex trading system in different countries

There are a few things worth mentioning right off the bat. When it comes to creating an online marketplace for currency trading, following the rules is essential.

We’ve gathered the regulatory bodies from different countries you should apply for to become a certified FX broker.

USA: The National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC). The two bodies establish rules for brokers concerning accounts management, operating capital, trading activity, reporting, and marketing.

UK: the policy of The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) are aimed at protecting traders and investors in case of the bankruptcy of Forex companies and define min operating capital and financial compensations.

Australia: The Australian Securities & Investments Commission (ASIC) and other governmental organisations are responsible for licensing Forex businesses and set criteria for financial transparency and safety.

Canada: To enter the FX market, brokers should satisfy the requirements of several authorities – Canadian Securities Administrators (CSA), NFA, and CFTC. Rules are strict and aimed at protecting the rights of traders.

Creating a powerful online system for FX trading might be challenging but there are few reasons to do this:

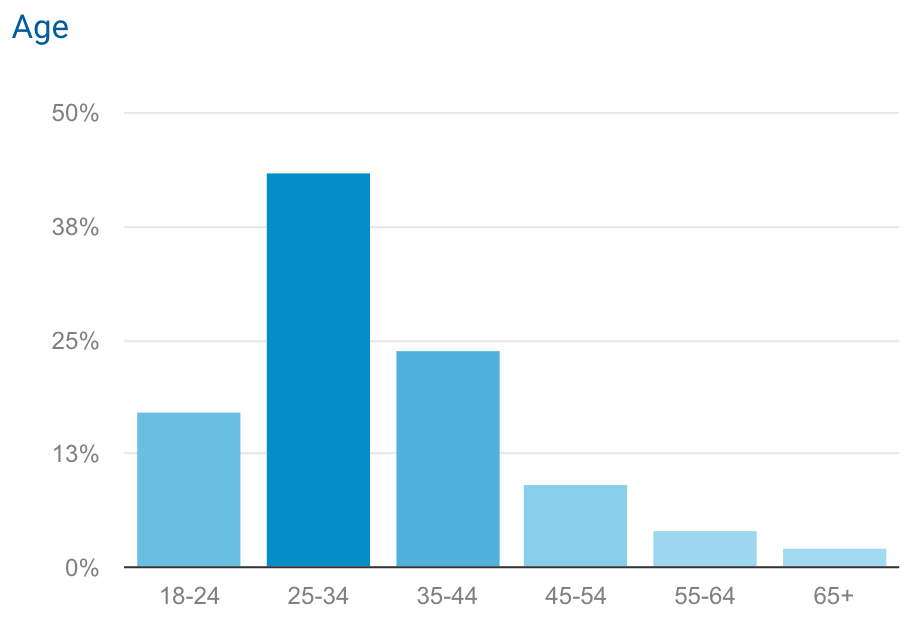

- about 44% of all traders are tech-savvy Millennials who seek advanced features and excellent trading experience;

- more than one-third of all deals are made by mobile traders that’s why it’s important to make your system adapted for smartphones;

- video content is gaining momentum, which means your marketing campaign may be more efficient if based on it;

- about 50% of traders consider AI as a crucial factor for their financial decisions so you can incorporate AI elements into your data analytics and strategy consulting;

- the voice search is becoming more and more popular and this feature may turn your site/application into the market leader.

Tech features you need to build a forex trading platform

A trading platform usually requires a specific design which we’ve covered in an article about creating a custom trading website design.

Today we’ll focus on the tech side of the trading activities that we’ve gathered in a list below.

1. Free demo accounts

Some platforms e.g. XTB and FOREX.com offer free demo accounts enabling users to try their hand in buying/selling currency for free.

To get a demo account, the user should fill in a short form and submit a request.

Typically, such free accounts are created, on average, for 30-40 days and are absolutely risk-free.

2. Automated order execution

Once a user has created a trading strategy, they can delegate the execution of orders to the auto-trading feature.

For instance, automatic trading at Fibo Group can take different shapes: users can rely on a robo advisor, subscribe to the trading signals system or apply for pro advisors.

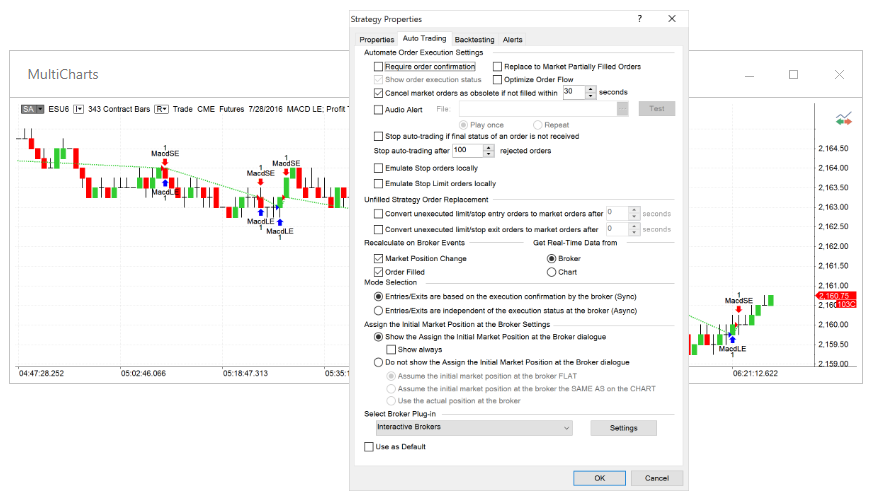

Another platform with an auto trading feature is Multi Charts: it supports different types of accounts, sends signals from several charts, and resend unfilled orders.

Auto trading is super beneficial to users as it eliminates their efforts on executing orders and monitoring the market.

3. Forums

If your goal is to create a forex trading website that will educate beginners, then you should equip it with a forum.

BabyPips did a great job implementing their forum. Users can join trade discussions, ask questions, view platform announcements and give their feedback.

With a simple filter, traders can choose what threads to view. Each topic refers to certain category – Analysts, Tech&Tools, Altcoin discussion, Announcements.

Also, there are details about users’ activity and recent replies on each topic.

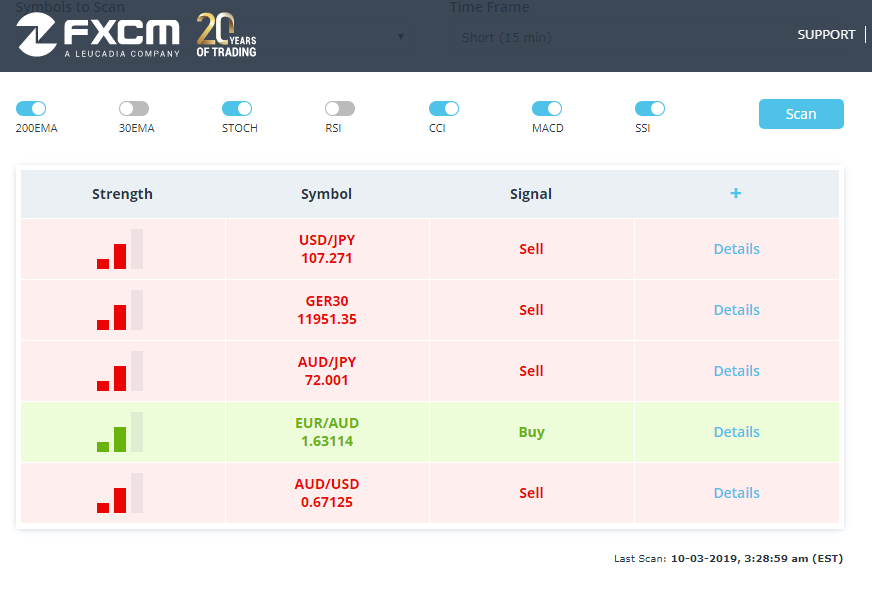

4. Currency scanner

Currency/market scanner is a real must-have for any FX trading software as it allows traders to view the market state based on the preferable tech indicators.

Users can choose symbols and time frame to scan, then click on Scan and get the table with the results.

For instance, FXCM’s Market Scanner describes each symbol in details and the system advises traders either to sell or to buy it according to the certain strategy (200EMA, 30EMA) or index (MACD, SSI).

The MultiCharts Market Scanner is more advanced as it suggests playing with symbols: sort or mix them, view both real-time and end-of-day data, get visual alerts.

5. Search

It’s essential for complex FX portals to have a search with predictable results.

When a visitor lands on the Homepage they want to find the necessary information in a matter of minutes and with search functionality, it’s not a problem.

Make sure that your search bar can be easily found; a good idea is to add it to the top toolbar.

If there are lots of search results returned to a user’s request, you can filter them by topics they refer to as in the below example.

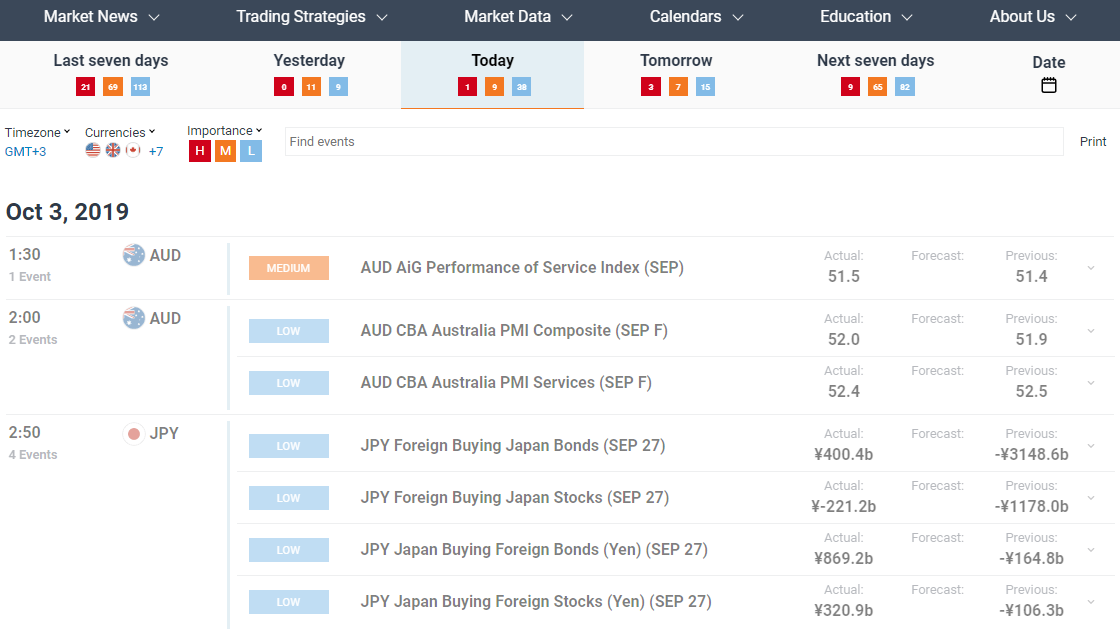

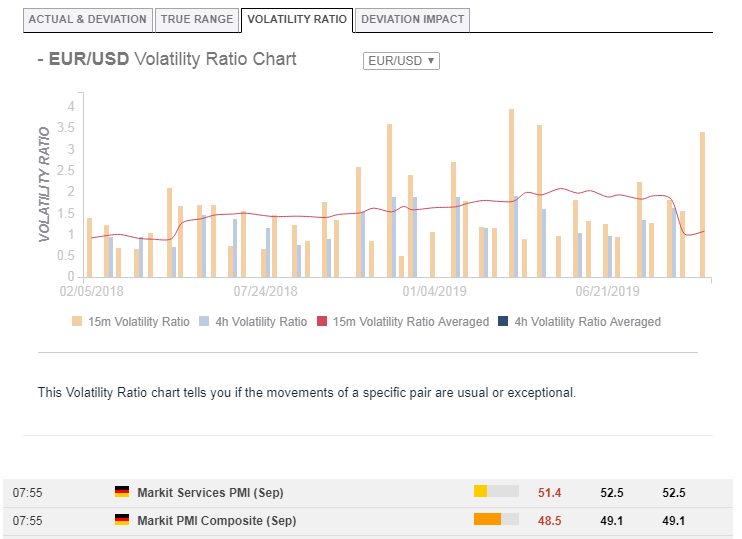

6. Economic calendar

It’s another essential feature in our guide on how to build a Forex trading system.

Almost any online trading system comes with an economic calendar, an element of the fundamental analysis, which demonstrates key global events that can influence the financial markets.

Traders can select a timezone, currency, timeline, and importance of events.

What’s more, when they click on an event, they can view its details – history or how this event impacted the market, the volatility ratio of a certain pair, etc.

7. Live charts

Feature-rich charts help traders take informative decisions about buying or selling currencies.

Platforms update chart packages every sec and let users customise the settings.

In this way, traders can decide what tech indicators to apply alongside the fundamental analysis to develop a successful trading strategy.

It’s vital that your charts respond instantaneously to market fluctuations and provide actual information.

Forex trading platform development: a stepwise guide

Let us show you on our own example what it takes to build a currency trading website.

1. Discovery phase

The main goal at this stage is to learn better the client’s business, discover functional and nonfunctional requirements to a platform, analyse the target audience.

All this helps us understand the business idea better and offer the right solution.

Also, at this step, we create the strategy and plan of our future collaboration based on two business models – time & material and dedicated teams.

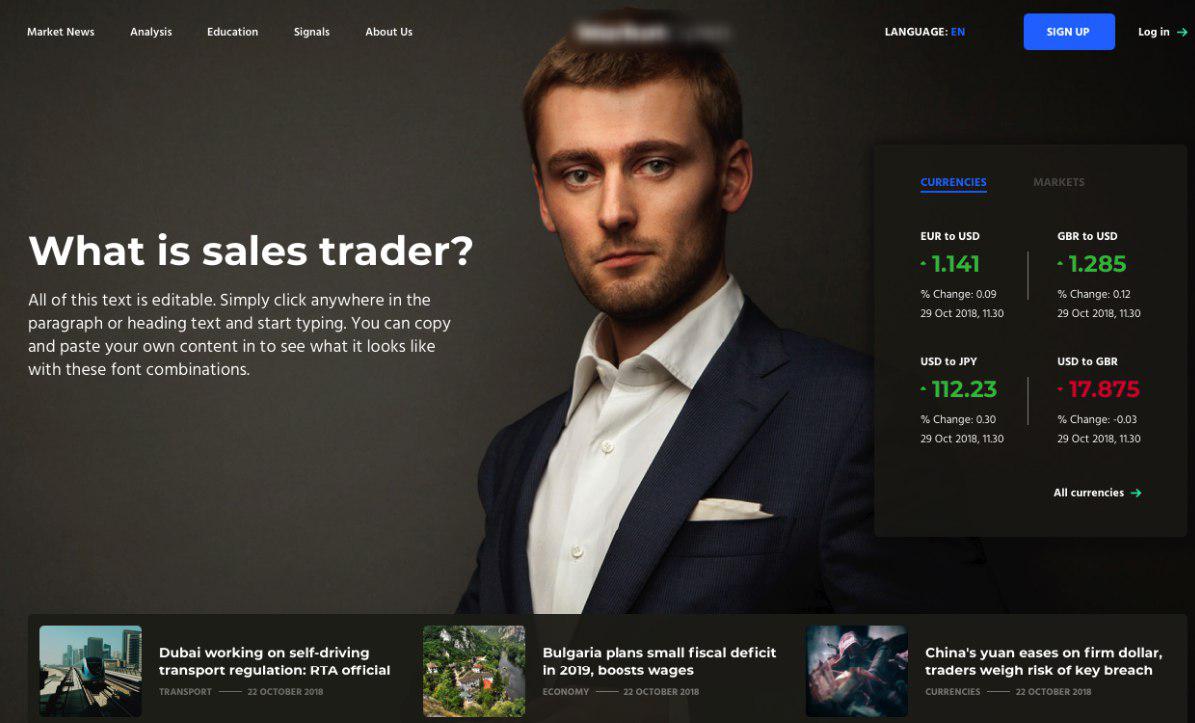

2. Bespoke web design

To create a user interface and visual design that will satisfy even the most demanding users, we apply the human-centred approach.

First, we work on the UX part – we create user flows and stories, build architecture and sitemap, run competitive analysis and a lot more. The best practices in UX help us design a user-friendly product.

Then, we move to the visual part: from low-fidelity prototypes to hi-fi mockups we create sketches of every web page and prepare site versions for different devices.

The outcome of this stage is a complete design of a platform and a style guide for developers

3. Development

Now the development team get in the game. To deliver the end product on time, we use Agile methodology and demonstrate results every 2 weeks.

Tech specialists work on the front-end and back-end of a platform, integrate it with third-party tools, implement core and extra features.

The performance and usability are checked by our QA team both in the development process and right before the launch.

4. Platform launch

doesn’t mean that we abandon you. We always provide post-launch maintenance and support the growth of your product.

Either you want to expand the functionality of your platform or fix a bug, we’re always here to help. Feel free to check what our clients think about us at Clutch.

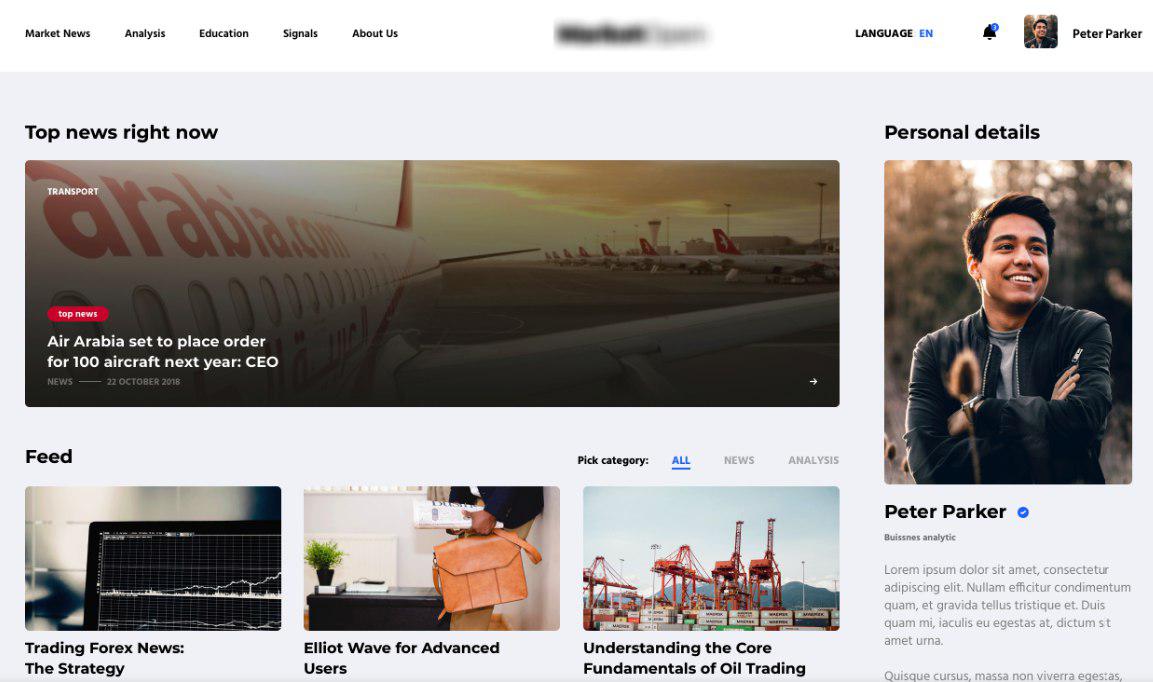

How do we implement the functionality for FX trading websites?

We’ve been working with several companies providing Forex brokerage services, FxPro and ADS Investment Solutions, in particular.

In each case, we did our best to create a fully working product that will satisfy users and bring profits to enterprises.

ADS Investment Solutions is a financial company from the UAE that deals with professional investors only and provide asset and wealth management services.

The platform has a clean and minimal design with light animation and effects.

ADS website is simply structured and consists of several pages – About us, Asset management, Wealth management, News and Media, Contact us.

Intuitive navigation and simple CTAs help users easily find the necessary content.

Other features of the website include search, slider sections, video content, integrated maps, contact us forms, etc.

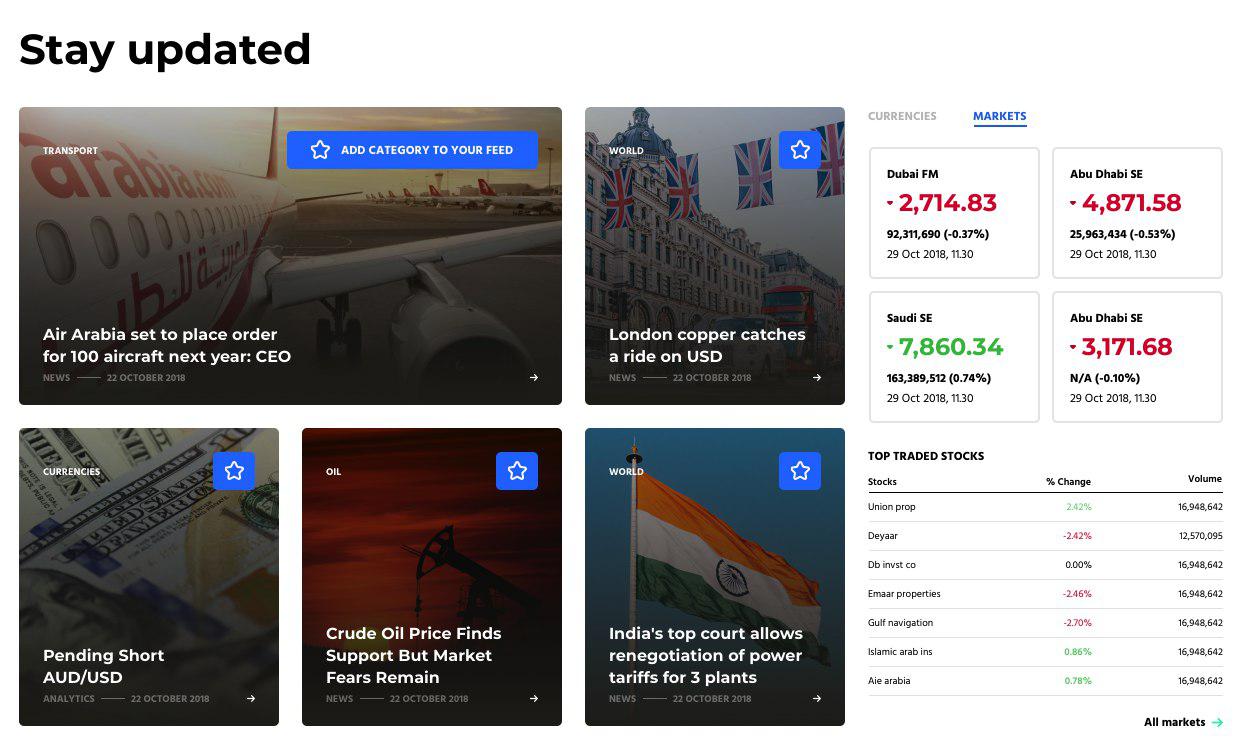

Below are a few more examples of a trading platform website we developed.

Forex trading platform development – Takeaway

A complex business requires complex solutions.

If you’re already in the FX brokerage, it means you’re not afraid of challenges and such a difficult task – to develop an FX platform – won’t scare you.

As a rule, the cost to create a Forex platform depends on its complexity and project scope, which, in its term, is determined by your business needs.