Plenty of crowdfunding software solutions out there built with WordPress or Joomla claim that creating a crowdfunding platform is relatively easy.

It’s right for smaller crowdfunding companies or local communities. However, serious business like online investment or crowdfunding needs a serious tech foundation that should be well designed and implemented:

- investment management;

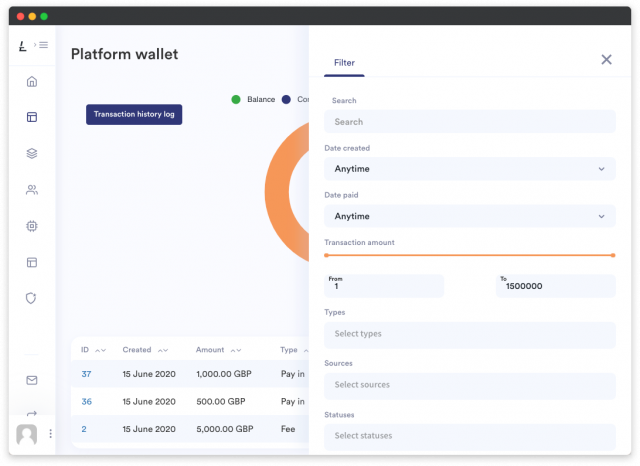

- e-wallets;

- payment processing;

- performance monitoring;

- data security.

In this article, we will go through different industries, business models and tech solutions to give you a better vision of how to start a crowdfunding website.

What you will learn:

Quick overview of crowdfunding platforms

Crowdfunding platforms nowadays are countless, and each of them has something of their own to offer—Kickstarter, Indiegogo, GoFundMe, Seedrs—you name it.

Types of products these platforms help get funded vary too, and by and large, you can crowdfund just everything!

From music and art to sustainable projects and legal matters.

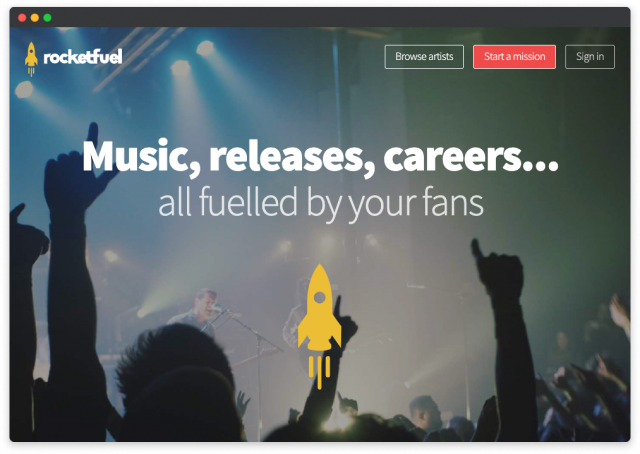

1. Music and art

Rocket Fuel, started by Resound Media, helps talents take off their musical career through a combination of reward- and donation-based deals.

This type of platform is quite simple and can be built with WordPress or a similar CMS even though there is an e-commerce element.

If the platform grows bigger or changes the business model (e.g. supporters will earn a percentage from future sales), a different technology, as well as regulatory authorisation, will be required.

2. Green energy

The sustainable and renewable energy sector is booming.

In Germany alone, there are more than 20 green energy crowdfunding platforms that offer investments in projects like solar power parks and energy-efficient housing.

With the accelerated adoption of sustainable energy in Europe and other countries, it’s clear that green energy projects and startups will grow in number and require funding.

From the tech point of view, crowdfunding platforms in this sector require quite sophisticated crowdfunding software for debt or equity investment models, KYC modules from reliable providers, client money management, and compliance with regulatory authorities.

3. Real estate

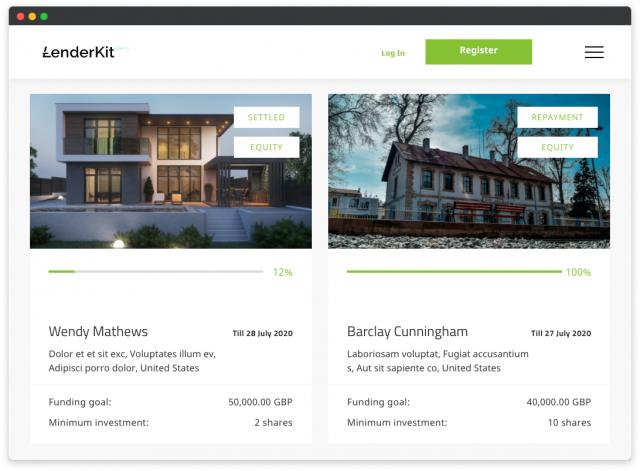

Online portals for raising funds for property projects occupy an essential place in our portfolio.

We’re proud that the design and functionality we create for our clients helped their platforms to achieve better performance.

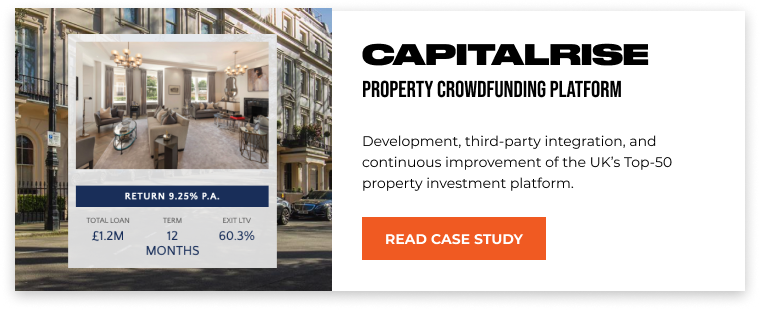

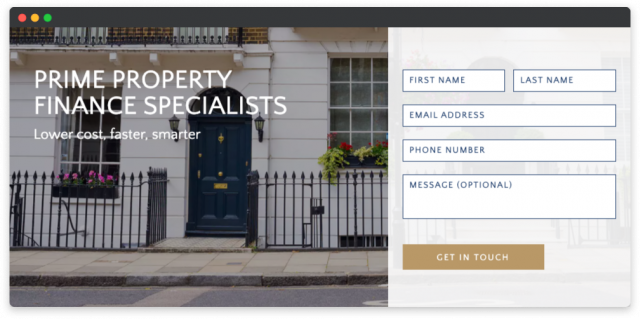

CapitalRise

CapitalRise is a real estate crowdfunding platform based in London who we helped create a custom crowdfunding portal and continue with ongoing improvements to date.

The company offers investment opportunities for prime-property projects and works with everyday backers giving them a chance to take part in projects with attractive returns. CapitalRise provides both equity and debt products by founding the SPV to issue shares or bonds. The investment minimum is £1,000.

Real estate crowdfunding in Europe is more attractive as it’s much easier to enter this market due to lower requirements towards investors as compared to the United States.

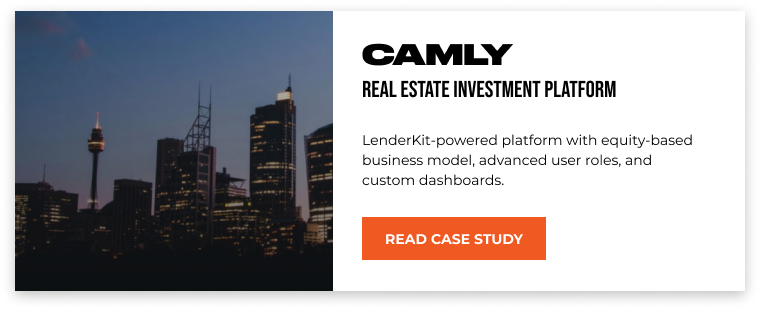

Camly

If you are going to build a crowdfunding platform with EB5 investment opportunities, we recommend checking Camly.

It’s a real estate crowdfunding platform that offers investment in the US property to the Asian market, which we built using our real estate crowdfunding software — LenderKit.

Real estate crowdfunding in Europe is more attractive as it’s much easier to enter this market due to lower requirements towards investors as compared to the United States.

Setting up a crowdfunding platform for real estate: JustCoded experience

Online portals for raising funds for property projects occupy an important place in our portfolio.

We’re proud that the design and functionality we create for our clients helped their platforms to achieve better performance.

CapitalRise

CapitalRise is a real estate crowdfunding platform based in London who we helped create a custom crowdfunding platform and continue with ongoing improvements to date.

The company offers investment opportunities for prime-property projects and works with everyday backers giving them a chance to take part in projects with attractive returns. CapitalRise provides both equity and debt products by founding the SPV to issue shares or bonds. The investment minimum is £1,000.

Real estate crowdfunding in Europe is more attractive as it’s much easier to enter this market due to lower requirements towards investors as compared to the United States.

Camly

If you are going to build a crowdfunding platform with EB5 investment opportunities, we recommend checking Camly.

It’s a real estate crowdfunding platform that offers investment in the US property to the Asian market, which we helped build using our real estate crowdfunding software — LenderKit.

Best practices for a successful P2P lending platform

Let’s cut to the chase and see in detail how exactly you can earn from your crowdfunding platform, how it will work for your customers, and what you need to build one.

Crowdfunding, like any other financial affair, is strictly regulated. So, before entering the market with your online platform, discover the crowdfunding legislation it regulates.

The US and UK have the best adapted to crowdfunding realities regulatory frameworks.

The FCA regulates equity and loan-based crowdfunding (peer-to-peer lending). Any crowdfunding company with these business models should require the FCA authorisation to conduct online and offline investment transactions.

The body imposes tight requirements for the min capital, investor cooling-off period, platform marketing and promotion, etc. Only those backers who meet the FCA eligibility criteria can take part in crowdfunding deals.

The core strategy of the FCA is to create a crowdfunding regulatory framework that would protect backers and decrease the high risks of fundraising deals.

The major crowdfunding regulations in the US are Regulation CF, Regulation A/A+, Regulation D and Regulation S. We’ve covered the legal American alphabet in multiple articles (here and here) and even compiled a report for clientele.

All crowdfunding businesses in the US operate as broker-dealers and funding portals under the SEC and FINRA jurisdiction.

Reg A, Reg D and Reg CF differ by the max possible amount raised, issuer and investors requirements, SEC filings, etc.

Starting from November 10th, 2021, following a 12-month transition period, harmonised regulations for European Crowdfunding Service Providers (ECSPR) apply to the entire European Union.

The undertaking was initiated by The European Securities and Markets Authority (ESMA) and marks a huge milestone in unifying a regulatory framework for industry players across Europe.

The ECSPR important aspects of crowdfunding activities include reporting, cooperation between authorities, authorisation, conflict of interests, etc.

By a rule of thumb, particular crowdfunding requirements demand implementations of unique features.

For example, one of the ECSPR requirements is the Key investment information sheet (KIIS).

The KIIS contains information about the project owner, products/services they offer, legal and management information, description of the crowdfunding project.

Since the KIIS is a mandatory requirement, crowdfunding service providers have to implement its acceptance procedure during the borrower onboarding.

Other functional requirements for a platform stem from the laws and rules of how providers must process monies, report to regulators, and meet compliance.

Granted, you are already familiar with crowdfunding regulations in your country; let’s get technical.

The basic features every crowdfunding platform should have is investor and borrower onboarding with built-in KYC checks and payment processing modules.

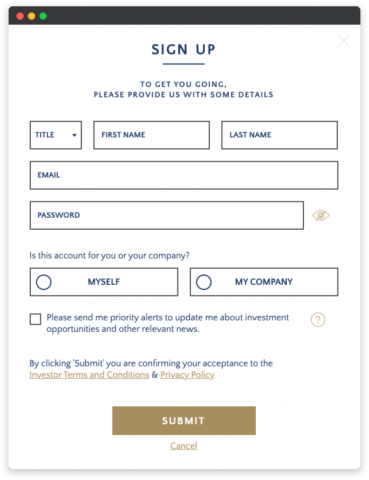

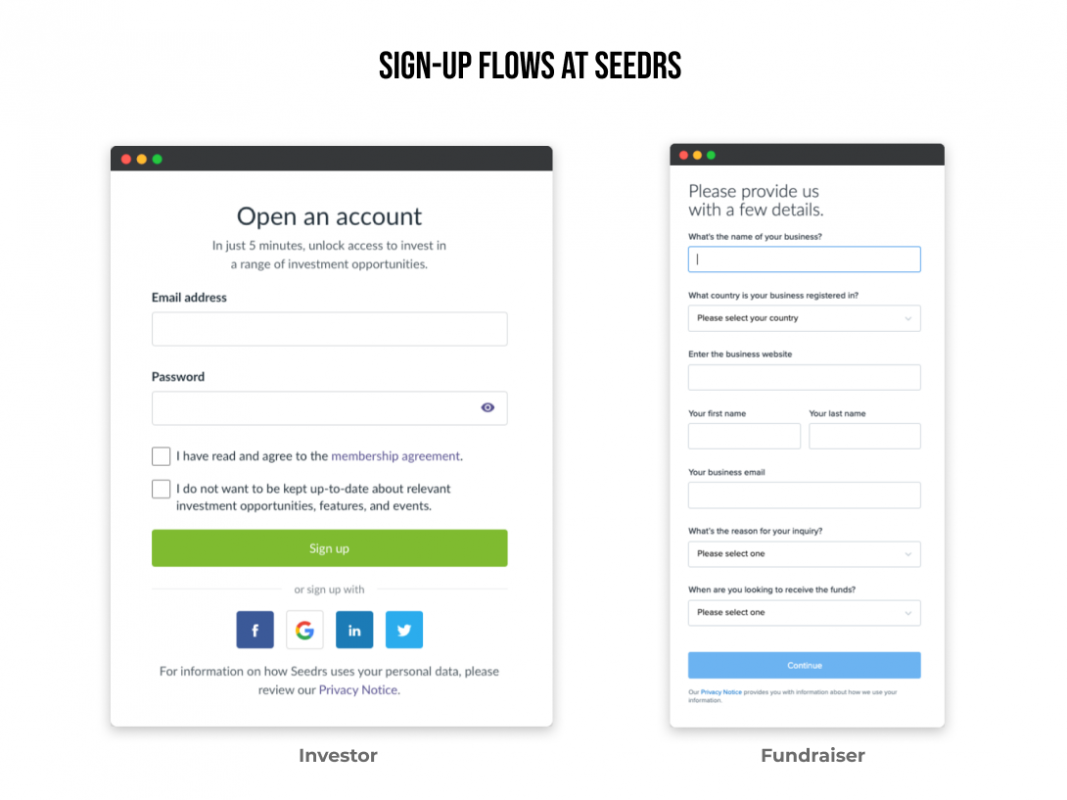

A typical crowdfunding platform allows the registration of both borrowers and lenders, which can be united into one flow or broken down into two registration forms for each role from the very beginning.

Usually, borrowers should create their campaigns or offerings, describe the details, assign open/close dates, set the funding goal, manage their transactions and repayments.

Some platforms have a manual process for borrower qualification and require them to get in touch with the crowdfunding company specialists first; everything depends on the specifics of your business nature or industry.

By default, regulators oblige platforms to implement appropriateness and suitability tests in their onboarding modules.

Appropriateness assessment is designed to make sure that backers have relevant knowledge and experience in p2p lending and equity crowdfunding.

According to COBS 10.2 (the FCA Handbook on appropriateness assessment), the investor tests aim to identify whether the service provided is appropriate to the backer and understand the level of the backer’s awareness against investment risks and returns.

In the US, investment firms, crowdfunding companies and advisers should meet FINRA Rule 2111 on suitability checks.

Crowdfunding service providers should meet appropriateness testing requirements to better protect the investor community and propose only the most relevant offerings.

Investor categorisation is a result of appropriateness tests: every backer is assigned with a status: accredited (sophisticated) or non-accredited (non-sophisticated).

Seedrs, for example, has an extremely easy signup for investors (followed by a massive KYC questionnaire though), while startups wishing to crowdfund their projects get a detailed signup form right away.

Investor credibility is the first thing that is checked via KYC procedures. It can be done manually, which usually takes a lot of time and involves many people, or it can be automated and performed on the go.

There’s also a hybrid approach — some parts of the assessment are put on autopilot, others are done by humans.

Many services provide KYC (Know your customer), AML (Anti-Money Laundering), and due diligence checks, and it’s a good idea to integrate them to provide a higher level of fraud protection.

Some payment gateways offer KYC as part of their service and even provide instant checks powered by optical character recognition.

We partner with several crowdfunding payment gateways and would be glad to give you advice if you need to implement transaction management into your FinTech project.

Investors should be able to view available offerings, manage their wallets (add funds), invest, and manage investments (cancel or withdraw). They may also be provided with some graphs and charts to check how their money is working and analyse the trends.

While it doesn’t seem very difficult from a user perspective, there’s usually a lot happening under the hood.

Investor credibility is the first thing that is checked. It can be done manually, which usually takes a lot of time and involves many people, or it can be automated and performed on the go.

Many services provide KYC (Know your customer), AML (Anti-Money Laundering), and due diligence checks, and it’s a good idea to integrate them to provide a higher level of fraud protection.

Some payment gateways offer KYC as part of their service and even provide instant checks powered by optical character recognition.

Summing up the above, here’s a list of features you should consider if you decide to start your crowdfunding business:

- credit score management,

- KYC and AML,

- ID verification,

- financial statistics and reports,

- personal finance management,

- support of multiple accounts,

- account tracking,

- data security,

- transaction management,

- admin back office,

- integration with third-party marketing services to promote the platform and crowdfunding campaigns.

Keep in mind that the experience should not only be safe but simple and straightforward. Make sure both investors and borrowers understand where they can find specific information, implement a clear structure and navigation, and make the website work perfect on all devices.

Payment gateway: what to choose

Since your crowdfunding or P2P lending doesn’t process any payments itself, you will need to go with a third-party solution. It’s totally fine as building a payment gateway from scratch is too complicated and expensive, let alone requires special licensing and agreement with a bank.

When it comes to picking the payment gateway for your transaction processing, the sky is the limit; however, not all of the payment gateways you see on the internet have crowdfunding-specific functionality.

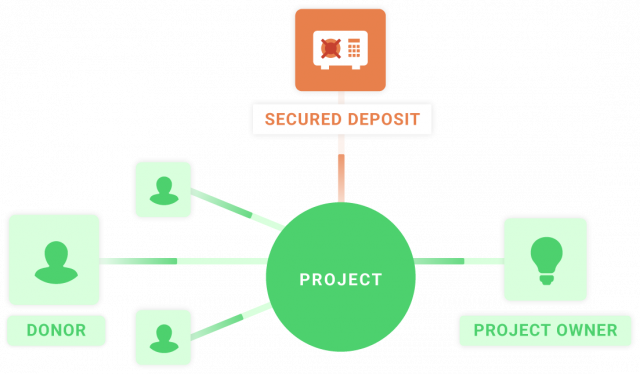

The typical set of transactional actions on a crowdfunding website includes creating online wallets, defining repayment schedules, adjusting interest rates, and returning funds to investors in case the campaign hasn’t been fully funded.

Most probably the first thing that comes to mind when thinking of a payment gateway is either PayPal or Stripe, but unfortunately, they are not tailored to online investment flows.

If you’re operating In the US, and are in the quest of an escrow payments provider, the best options will be Fund America, North Capital, GoldStar Trust, etc.

These third-party companies act as escrow agents or title companies authorised to hold investors monies in escrow accounts until offerings are completed and settled.

The most popular payment gateway providers in the EU are LemonWay, Mangopay, GCEN. They offer turn-key solutions and reliable services.

Should you need a reliable payment partner to start a crowdfunding platform in the UK, take a look at LemonWay or Goji.

Both payment gateway providers are excellent in terms of due diligence checks, automated transactions, regulatory support, payment flows tracking.

LemonWay offers numerous benefits for crowdlending and fundraising websites including smooth borrower and investor onboarding, integration via high-performing APIs, handy dashboards.

As a great bonus, Lemonway offers instant KYC, PSD 2 compliance, and Pay By Bank feature.

By integrating Tink’s payment initiation services (PIS), Lemonway expanded its digital payment methods portfolio.

Lemonway clients using this feature allow investors to initiate payments directly from their accounts without manually filling in payment details. It facilitates onboarding processes and protects financial transactions.

Goji solutions can be used for various payment methods and flows, e.g. creating user accounts or executing inbound and outbound payments. What’s more, Goji is authorised to provide a white label Innovative Finance ISA to investment managers.

They allow you to create wallets, securely hold funds, collect payments or make refunds to bank accounts as needed while having all the regulatory procedures in place, too.

Remember that the citizens of the UK who hold an Individual Savings Account (ISA) are eligible for tax-free interest on peer-to-peer investments of up to £20,000.

Bespoke solution or a ready-made back office?

It’s up to you and your project. You may opt for custom development or try white-label software.

Both scenarios have their advantages and disadvantages depending on your current demand and capabilities.

1. Custom crowdfunding platform development

Even though a fully bespoke solution to build a crowdfunding website takes a lot of time, you get your very own platform with full control and freedom to customise it the way you need.

You can integrate it with any third-party system, implement a basic or sophisticated back office, and be in charge of everything that happens under the hood of the system.

CapitalRise is a great example of a custom crowdfunding solution. We built a strong foundation first and then gradually added extra functionality, with more modifications happening as we speak. As the company fully owns the platform, it can adapt to market changes very quickly by altering parts of the platform right away.

If you start working with a web development agency and hire a team of highly-skilled crowdfunding platform engineers and designers, the turnaround of implementing everything a P2P lending platform requires may take half a year.

”]2. Using crowdfunding software

If you need to get your crowdfunding platform to market or VCs fast, it’s worth looking at a ready digital infrastructure that comes with a fully-working back-office.

Some software is fine-tuned for certain local regulations, others are pre-defined and leave a small room for customisation.

Depending on the vendor, you can get a platform with a marketing website too (the client-facing part).

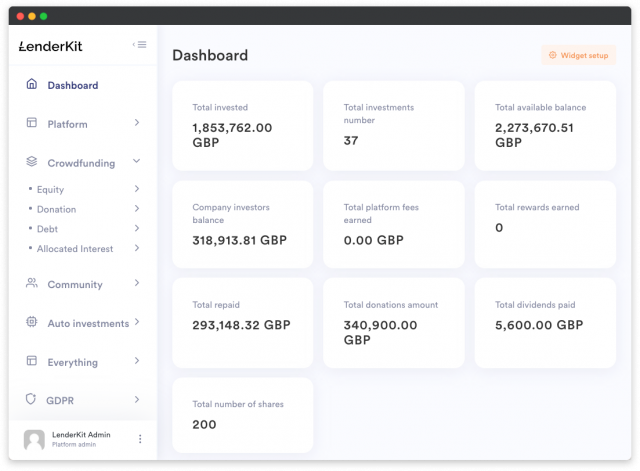

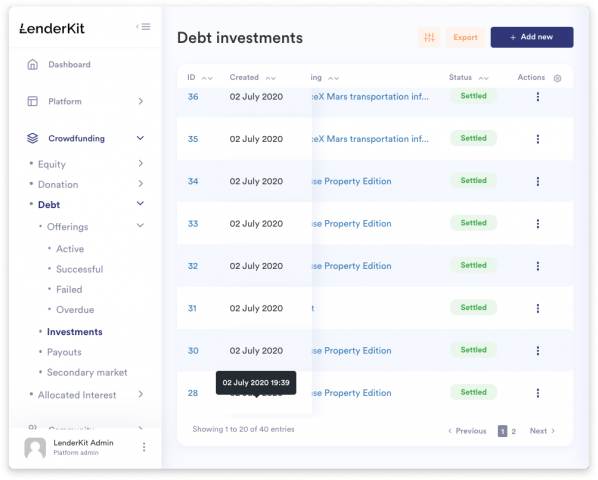

Crowdfunding platform development can be way easier with LenderKit – our in-house built crowdfunding software. It’s a great choice for an MVP and a solid foundation for a platform that will be further customised.

It’s suitable for any kind of crowdfunding business (real estate, green energy, art, etc) and any business model (equity, P2P, donations).

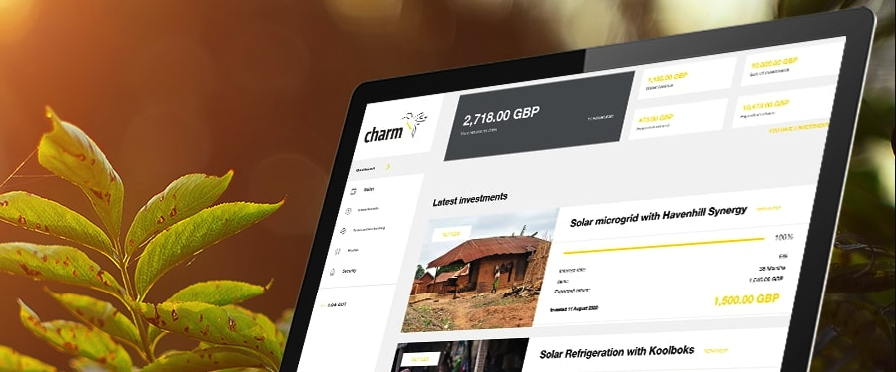

Charm Impact, for instance, built its platform with LenderKit to present it to investors and seek funding for further development. We were able to launch it in less than 2 months using a predefined theme (which we tweaked with Charm Impact colours of course) and will continue to build up more functionality after Charm Impact received the required funding.

What benefits you get when choosing LenderKit to build your own crowdfunding platform:

- powerful front-end and back-end that is fully under your control;

- responsive layout and pro design;

- automated payment flows, KYC/AML and due diligence checks;

- secondary market and third-party integrations;

- ability to add custom features via developer-friendly APIs;

- flexible solution that can be adjusted to any regulatory ecosystem;

- effortless migration of databases to your servers.

On a side note

No matter how you decide to build your crowdfunding site, never disregard the legal side.

Make sure to hire an experienced lawyer who is ready to assist and never claim that your platform is risk-free – we all know nothing is risk-free. If you’re dealing with real estate or securities, the law is not something to be taken lightly. It will be a massive plus if you have someone with extensive experience or education in the banking and finance industry on your team.

If you start your crowdfunding business in the UK, it will have to go through FCA (Financial Conduct Authority) procedures to determine regulatory compliance, so make sure to allocate time to fix probable issues and implement updates according to FCA guidelines.

Ready steady?

Crowdfunding platforms are not only about monetary benefits. Depending on the sector, a crowdfunding site may help you and your investors find this sense of fulfilment that we all are looking for.

Starting a crowdfunding business is just like starting any other business – it’s always hard until it’s easy. We have built several platforms, gained knowledge in this field, and will be happy to assist you in building a crowdfunding website for you.

- How much does it cost to develop a crowdfunding platform?

According to our survey, financial companies spend on average at least 89,000 EUR to build a crowdfunding platform. Of course, this is the average amount; the actual cost would depend on the complexity of your business model, integrations, specific regulatory requirements, design etc.

There is an option to buy white-label crowdfunding software and customise its further.

If you are a startup, it makes sense to launch with an MVP first and expand the platform further as you get funding. Talk to our FinTech strategists to find out the cost for your specific case.

- What are the crowdfunding regulations in my country?

Regulations are very specific to the jurisdiction where you will operate your crowdfunding business. We recommend to check out the following information:

- overview of crowdfunding regulations in different countries;

- crowdfunding regulations in the UK;

- crowdfunding regulations in the USA;

- crowdfunding regulations in Saudi Arabia;

- crowdfunding regulations in Spain;

- crowdfunding regulations in Africa.

- How long does it take to develop a crowdfunding platform?

You can launch an MVP with basic investment and fundraising flows in as little as 2 months.

Check out LenderKit and schedule a demo to find out how exactly the solution can adapt to your needs.