In the UK, you cannot start a P2P lending platform without authorisation from the Financial Conduct Authority (FCA) — a body that regulates financial activities.

While some types of crowdfunding are spared from the regulation, other types will face stricter laws. If you plan to build your own crowdfunding platform, in this article, you will find out the FCA crowdfunding rules in 2021 and where they apply.

What you will learn:

How is crowdfunding regulated in the UK?

There are not so many countries in the world that regulate alternative ways of funding yet. Very few European states do that, and the UK was one of the pioneers.

Equity crowdfunding, however, has been regulated in the UK by Financial Services and Markets Act 2000 even before the “crowdfunding term was coined.

All transactions related to investments have to be authorised by the regulator (Financial Services Authority at that time), should they be arranged online or offline.

In March 2014, the FCA (formerly FSA) introduced new rules to regulate crowdfunding.

They aim to facilitate the development of the industry in order to:

- attract both investors and lenders;

- protect consumers by ensuring transparency and availability of information;

- improve the state of the UK financial system;

- encourage positive competition in the sector.

What types of crowdfunding are regulated in the UK?

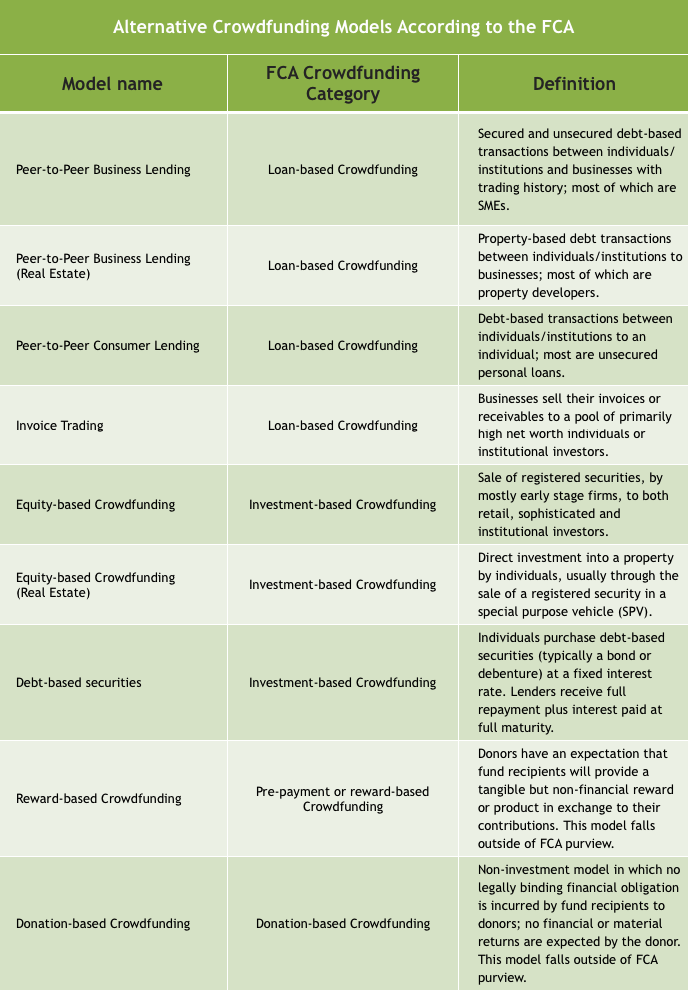

Today, the FCA regulates equity and loan-based crowdfunding (peer-to-peer lending). Donation and reward-based crowdfunding platforms are spared from the regulation as they don’t offer equity stakes or return.

In February 2015, the FCA published a detailed review of the regulatory regime of crowdfunding, where they examined the implementation of the new rules, the effectiveness of the new regime, and the key concerns.

Later in December 2016, the authority published Interim feedback to the call for input to the post-implementation review of the FCA’s crowdfunding rules.

The rules focus on providing the consumers who wish to lend their money with clear information to assess the risk and realise who they ultimately lend to.

As the platform owner, you must protect client money and have a resolution plan in case things go off the rail.

The FCA regulations for peer-to-peer lending

Previously, peer-to-peer lending platforms were regulated by the Office of Fair Trade (OFT).

Once the FCA took over, they granted all the firms holding OFT licenses before April 1st, 2014, interim permission to continue operations while preparing for the FCA authorisation. The companies that registered after April 1st, 2014, have to go through a complete authorisation cycle.

The main concern of the Financial Conduct Authority is that loan-based crowdfunding platforms position their services as equivalent to holding money on deposit, thus misleading the investors about a great risk of losing some or all of their money.

According to the FCA, loan-based crowdfunding firms should make the necessary changes to their websites to be fair, clear, and comply with the regulator’s rules.

P2P lending rules include the following:

- The minimum capital to operate a P2P lending platform — €50,000. The FCA plans to increase the current capital requirements under the new prudential regime up to £75,000.

- Expose transparent information about the platform to allow customers to understand who they are dealing with.

- If the platform compares its interest rates with interest from a regular savings account, it must be clear and not misleading.

- Any marketing materials (brochures, online ads, or broadcast) must be fair; otherwise, the FCA can ban them.

- All risk warnings should be prominently indicated.

- No cherry-picking or deliberately omitting the information that can create an unrealistically optimistic impression of the investment.

- Investors can get in touch with the financial ombudsman service to handle complaints.

- The borrowers have a cooling-off period of 14 days during which they can withdraw from the deal.

The FCA regulations for investment-based crowdfunding

The FCA defines investment-based crowdfunding as a platform where “consumers may invest directly or indirectly in new or established business by buying investments such as shares or debt securities.

The rules include the following:

- Platforms may work only with clients who meet specific criteria:

- High net worth or sophisticated investors such as VCs and high-net-worth individuals.

- Clients who take regulated advice.

- Clients who can confirm that they will invest less than 10% of their net assets in a specific security.

- Firms should verify that customers realise the risks if they do not take regulated advice.

Updated rules for loan-based and investment-based crowdfunding platforms

In 2019, the FCA released a new policy statement for P2P lending and equity crowdfunding providers.

Suggested changes and updates aimed to secure an appropriate degree of protection for consumers.

The new rules focus particularly on credit risk assessment, risk management and fair valuation practices, especially for platforms with more complex business models.

The FCA, in particular, has clarified that:

- retail investors can be provided with information on specific investments before they have to complete a client classification process;

- appropriateness assessment needs to be undertaken before an investor can apply to invest;

- P2P platforms offering a target rate of return should provide proves that they can do it effectively (appropriate access to data, modelling capability and governance arrangements to do so effectively);

- platforms should provide guidance regarding calculating loan returns at a portfolio level and reference the variability of losses through the cycle;

- P2P platforms should assess and determine, depending on their business model, when they will be revaluing P2P loans;

- providers should disclose their considerations regarding the upcoming borrower’s default.

Changes apply to:

- P2P service providers;

- investment-based platforms;

- trade bodies functioning in the crowdfunding sector;

- individuals and businesses, potential and existing borrowers;

- intermediaries;

- consumer organisations.

As a result of new rules and laws, platforms have become well-governed and compete effectively for business; investors – have got clear and accurate information about the investment risk and are appropriately rewarded for it.

FCA crowdfunding 2021: changes and future steps

On a regular basis, the FCA issues warnings regarding investment scams. The recent one relates to “clone firm” fraudulent activities shows that the consumers in this industry are still vulnerable.

P2P lending platforms should monitor the regulator’s announcements as the regulations are expected to be very customer-focused and aim to change the way consumers perceive FinTech startups, thus giving the firms competitive advantages.

The recent FCA’s initiative was related to strengthening financial promo rules for high-risk investments.

The watchdog opened discussion on these rules in April, finalised it in June and is currently pulling up all the suggestions from the respondents.

A key theme of the discussion was the need further to segment the high-risk investments from the mainstream market and strengthen the rules for financial promotions for investments of this kind since they’re the single source of information for potential backers.

The FCA suggestions can be grouped into three categories:

- classification of high-risk investments (review of current definitions and p2p rules);

- high-risk investment market segmentation (firms should advance appropriateness tests; backers – take additional steps to prove their investor status);

- clear responsibilities for Section 21 (financial promotions for unauthorised persons should also be compliant with FCA rules).

Meanwhile, the FCA is processing the feedback gathered, and we may suppose that the watchdog will tighten the screws on p2p lending offerings soon.

The proposed requirements are going to become another reliability and burden for crowdfunding companies.

Further steps

And although the FCA initiatives are criticised for being too harsh, the watchdog keeps receiving requests from backers demanding more supervision.

So, in the nearest future, we may see the FCA:

- elaborating requirements for holding additional capital aimed at protecting investors in the event of platform failure;

- consolidating rules and instructions for platforms on the basis that the variety of business models is increasing;

- providing companies with a choice of implementation options depending on the services they offer and the size of their business;

- finding ways to reduce both the probability and impact of a failure of P2P platforms;

- keeping crowdfunding regulation UK proposals under review to adjust them to changes in the UK regulatory framework and its position outside the EU in the future.

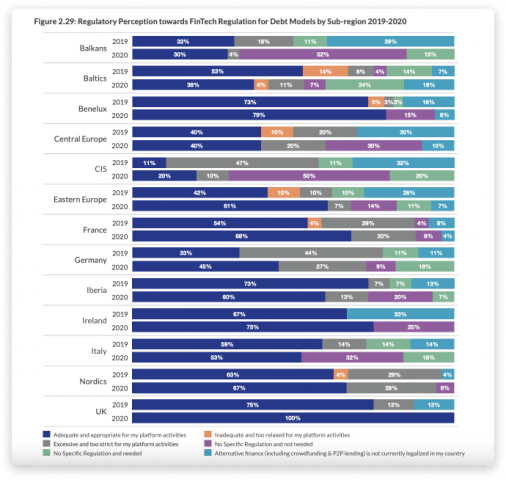

According to the new report published by the University of Cambridge, 100% of respondents from the UK believe that FinTech regulation for debt models is adequate and appropriate. To compare, in 2019 there were 75% of respondents believing that the current reg framework is adequate.

Our clients: companies under UK crowdfunding regulation

Shojin

Shojin Property Partners is a real estate crowdfunding company providing access to institutional-grade investment opportunities for UK-based and international angels and following FCA rules and regulations.

A unique feature of Shojin is that it participates in every project on a co-investing basis and shares the risks and benefits with other angels.

Shojin has its own due diligence procedures helping the company vet both investors and borrowers before they access the crowdfunding market.

Shojin follows the FCA recommendations and assesses whether its clients have the necessary knowledge and experience to understand the risks in the investment products they offer.

Shojin supports ISA and IFISA investments enabling investors to receive any returns they make on eligible crowdfunded investments without the tax burden.

Homegrown

Homegrown is a standalone crowdfunding company aiming to address a fundamental imbalance in the residential development market. It helps property developers to implement more projects, which leads to more homes in the UK. On the other side, new opportunities will pitch the attention of potential backers wanting to gain better returns.

Homegrown promises up to 13.4% returns on investments.

Homegrown partners with Global Custodial Services Limited who are authorised and regulated by the FCA.

The platform considered new FCA rules and regulations when creating a system for eliminating risks associated with investing in property.

All members should read their full risk warning before investing via Homegrown.

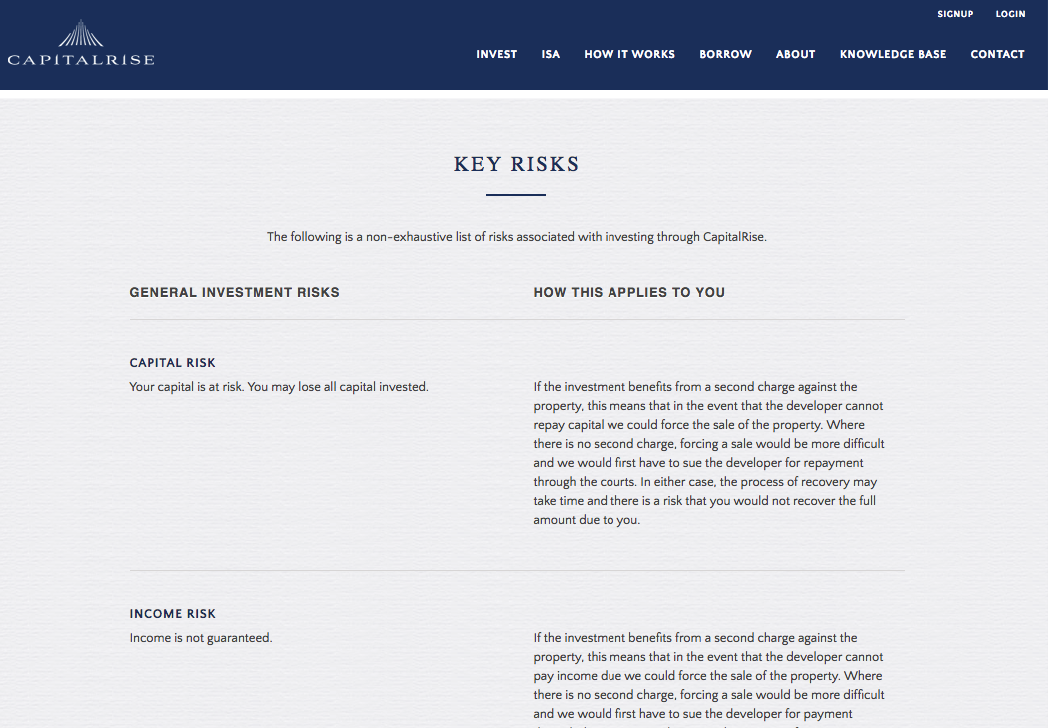

CapitalRise

CapitalRise is a group of professionals in property investments, technology, law and finance putting their own money into projects fundraised via the platform.

What sets CapitalRise apart from the crowd is vast experience in real estate crowdfunding, co-investing and zero administration fees.

CapitalRise Ltd is an Introducer Appointed Representative of Prosper Capital LLP which undergoes the FCA’s regulation of crowdfunding.

Despite offering ISA and IFISA investments, CapitalRise warns backers that all the deals are much riskier than savings accounts and include extra risks such as political, geographical, illiquidity, and environmental factors.

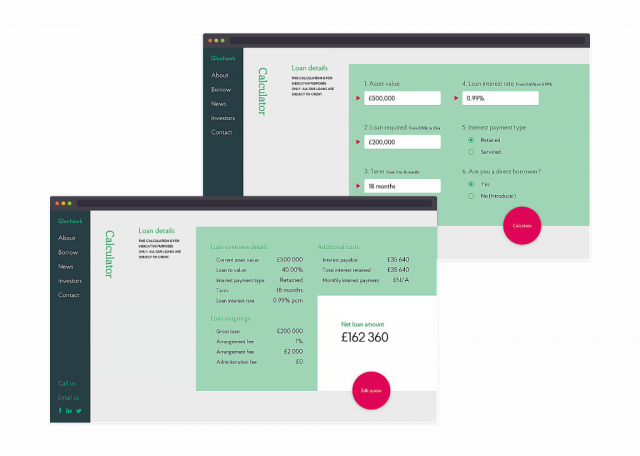

Glenhawk

Glenhawk is a financial institution from London providing swift, competitive short-term property finance, allowing clients to realise opportunities and progress developments.

The company provides short-term loans for commercial and semi-commercial, residential, refurbishment and 2nd charge real estate.

Glenhawk’s loans work as short term financial solutions, simple interim loans that can cover the first steps of financing a property.

Being authorised and regulated by the Financial Conduct Authority, the company complies with established regulatory rules and warn prospective and current backers about existing investment risks.

Since 2020, the company has been providing FCA-regulated products. This step helped Glenhawk access a wider audience and offer responsible lending and diligent underwriting services.

Bottomline

When you start your investment or loan-based crowdfunding business it’s your responsibility to ensure that everything you do stays in the legal framework.

JustCoded as a web-development company will be glad to help you implement all the necessary features required for FCA authorisation.

All of our key clients who run their online investment business in the UK — Shojin, HomeGrown and Glenhawk — have successfully passed the authorisation, so it’s not an impossible thing to do.