Legal disclaimer: the info in this article is for information purposes only.

James Patterson’s painful experience with investing via Funding Circle has become the talk of the town.

The unfortunate backer, attracted by attractive returns from P2P loans, donated £1,000 and earned… nothing. Instead, he lost £12; in a year and a half, his investment was worth £988.

After the platform fees and tax deductions, James appeared to be in the red.

In his interview with the Guardian, he explained that he wasn’t aware of the importance of diversification and just followed onboarding guidelines.

James isn’t the only one. Thousands of retail backers lose shirts trying their luck with crowdfunding platforms.

To protect the most vulnerable, the FCA and other regulators encourage crowdfunding companies to implement appropriateness and suitability tests in their onboarding modules.

Discover what an appropriateness test is and how to integrate it into your solution from our tips.

What you will learn:

Suitability and appropriateness test in the UK

As of 9 December 2019, the FCA introduced new rules to protect unsophisticated investors.

Appropriateness assessment is an integral part of the new regime. It’s designed to ensure that backers have relevant knowledge and experience in p2p lending.

The FCA believes that only those consumers capable of understanding the risks and bearing the consequences should invest in p2p agreements. Absolutely!

The P2P platform is responsible for assessing backers against their investment background. It’s up to the provider to decide where to place the test in the onboarding process. There’s only one requirement — the test should occur before any investment is made.

According to COBS 10.2, the investor tests aim to identify whether the service provided is appropriate to the backer and understand the level of the backer’s awareness against investment risks and returns.

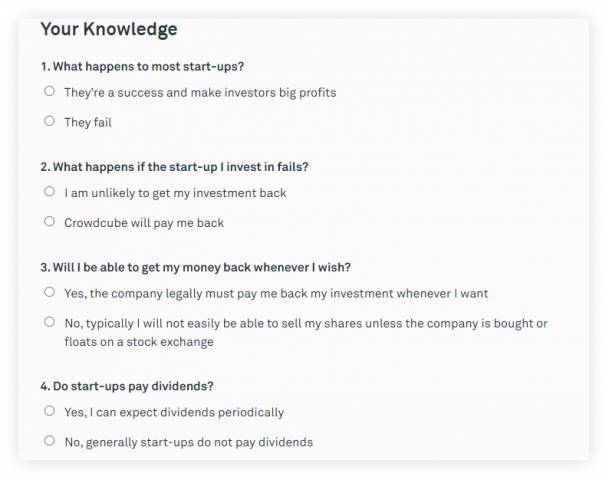

Questions should be multiple-choice and cover such topics: clients’ exposure to the risk, investment characteristics, the nature of the client’s relations with other parties, the characteristics of security interest, risk diversification and mitigation practices.

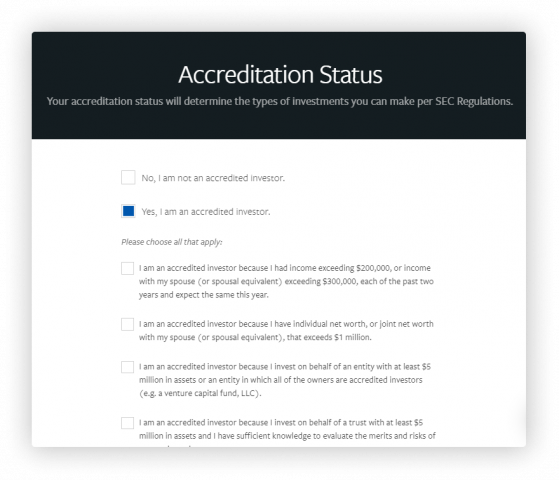

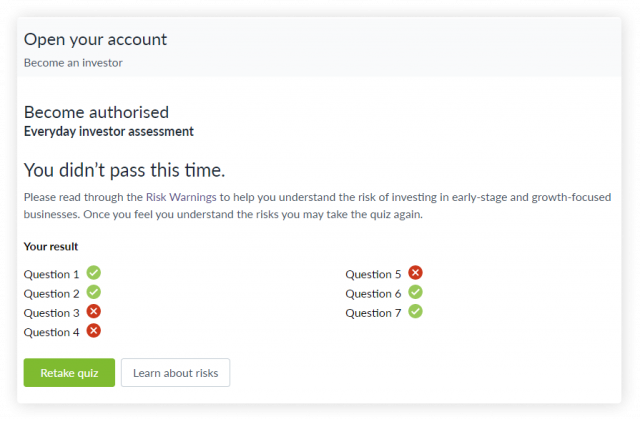

As a result of the test, the provider identifies the backer’s status: everyday investor, sophisticated backer or High Net Worth individual.

Some platforms ask clients to identify their status themselves and then double-check it.

If the provider doesn’t receive sufficient information, it shouldn’t provide the backer with access to current offerings.

The FCA appropriateness rules were initially introduced in MiFID (Directive 2004/39/EC) later replaced with MiFID II.

The directive distinguishes suitability from appropriateness.

Under MiFID II, suitability tests are applied to complex deals involving investment advisers. In case an institutional or everyday backer doesn’t provide the info on their financial situation, investment objectives, knowledge and experience, the platform shouldn’t be allowed or recommend investment services.

Appropriateness is checked when backers don’t turn to investment advisers and act on their behalf in complex deals, e.g. on crowdfunding platforms.

In non-complex deals, the test is deemed to be unnecessary.

European Union: self-appropriateness test requirements

European regulations for crowdfunding platforms have come into effect this November.

The technical standard rules still have to be approved by the European Commission. However, many crowdfunding platforms have already started the adjustment process they need to complete before November 2022.

Non-sophisticated investors need to take a test to prove they understand the risks involved with investing on the platform.

The test usually has several multiple-choice questions configured by the platform administrator. From what we see now, it looks like the European crowdfunding regulations allow non-sophisticated investors to proceed with investing even if they didn’t pass the test successfully. In this case, an investor should see an explicit warning informing them of the risk.

What is a suitability test in the US?

Every investment firm, crowdfunding company or adviser in the USA should meet FINRA Rule 2111 on suitability check.

Citing the rule:

A customer’s investment profile includes, but is not limited to, the customer’s age, other investments, financial situation and needs, tax status, investment objectives, investment experience, investment time horizon, liquidity needs, risk tolerance, and any other information the customer may disclose to the member or associated person in connection with such recommendation.

While for some backers, speculative investments remain taboo, professional angels might be comfortable taking significant risks.

Why should crowdfunding companies bother with investor appropriateness and suitability?

- to comply with the regulator’s requirements and industry standards;

- to better protect clients and educate them;

- to propose those offerings which work best for investors;

- to ensure borrowers that the pool of investors deliberately take risks;

- to be able to operate cross-border and adjust to different regulatory regimes.

Challenges that appropriateness tests might entail:

- tedious and complicated procedures may distract potential investors;

- unclear and complex questions may mislead sophisticated backers;

- repeated tests may lead to inaccurate and different results.

Best practices for the appropriateness test implementation

To ensure tests bring the results, they’re supposed to follow TISA’s recommendations:

1. The platform may choose when to assess future lenders: either during the registration on the platform or right before investing.

2. Order execution shouldn’t be automatic; the platform should put a warning about risks involved in the deal before executing the order or request relevant info (if the investor hasn’t provided it).

Remember that assessment tests are not required for non-complex deals.

3. The FCA stated that investments made before 9 December 2019 and automatic reinvestments are exempt from the assessment tests. If the firm decides that an existing client has enough knowledge and experience from the data they possess, an appropriate assessment can be skipped.

4. The platform may conduct several appropriateness tests for a good reason: for example, if company products differ materially or if the product has changed since the last appropriateness test.

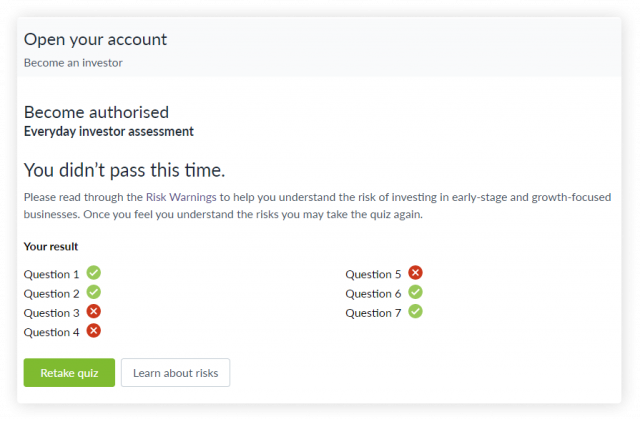

5. It’s important to take into account that results shouldn’t be considered as binary pass/fail.

TISA advises firms to indicate whether the customer:

- understands the matters of the investment;

- does not understand and is not capable of understanding;

- does not understand but is capable of understanding.

If an investor-to-be hasn’t passed the assessment test, the platform should consider how to educate the customer before the next test.

6. COBS 10.7 record keeping guide requires platforms to maintain records of the appropriateness assessments for a minimum of five years. The records should include:

- test questions and results;

- the result of the appropriateness assessment;

- any warning given to the customer if they didn’t provide sufficient information, assessed as a potential investor/failed to pass the test, etc.

7. Every platform decides what set of questions to apply. TISA offers a standard questionnaire; also, you can run competitor research or create a list of the questions that match best your niche and target audience.

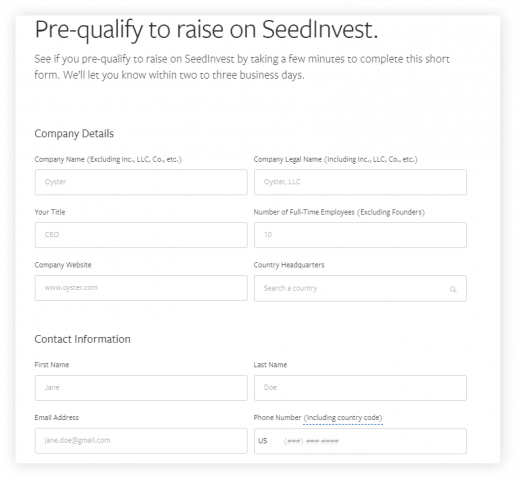

New players and existing clients may find it challenging to integrate an appropriateness test module into existing platforms. Luckily, there are off-the-shelf solutions like LenderKit that solve this pain.

P2P appropriateness test in LenderKit

If you’re not familiar with LenderKit, here’s a short overview of our in-house solution.

It’s a highly customisable white-label crowdfunding software with high-level software components and out-of-the-box features.

LenderKit components include marketing site layouts, an investor portal and fundraiser portal, and a powerful back-office.

It’s a universal solution covering investment flows for equity, debt donation and rewards crowdfunding. Clients can customise these flows and offer multiple services to their clients.

Out-of-the-box LenderKit features include:

- investment modules,

- fee management,

- secondary market,

- Lemonway integration,

- permission settings,

- e-wallets,

- ECSP settings,

- GDPR module.

With the help of LenderKit, we helped startups and businesses from the US, MENA region, Saudi Arabia, Europe and the UK launch and enter the market fully compliant with national crowdfunding regulations.

We are pleased to announce a new LenderKit feature — an appropriateness test module.

It’s a highly-customisable module that you can fine-tune depending on how strictly you plan to manage the onboarding process on your platform or how strictly it’s regulated in your jurisdiction.

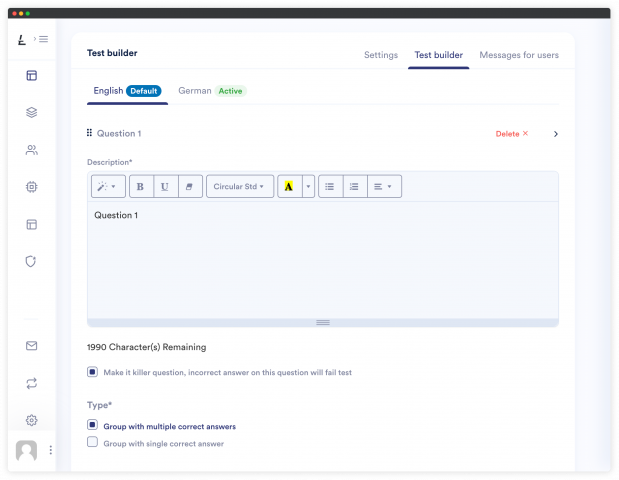

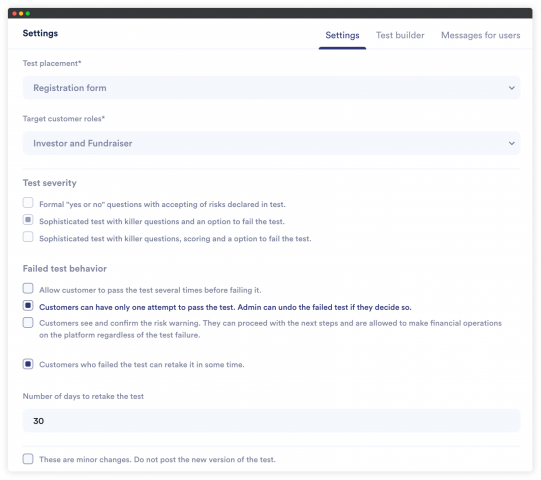

The appropriateness test module consists of the general settings and a test builder.

General settings allow you to define what will happen if an investor fails the test, how many attempts are allowed, are there killer questions that automatically decline the registration, the exact placement of the test, the number of days to retake the test and so on.

Bottom line

So, what you should know about FCA appropriateness tests and FINRA usability assessment:

- Since December 2019, the FCA has required crowdfunding providers to run investor tests and check their knowledge, understanding, and willingness to take risks;

- FCA appropriateness tests are aligned with MiFID II requirements and should be applied to complex investment deals;

- crowdfunding companies are supposed to follow FCA guidelines and best practices regarding tests implementation and questionnaires;

- FINRA obliges US-based players to conduct suitability tests to make sure investors provide the relevant financial info;

- the easiest way to meet FCA and FINRA requirements, deploy a ready-made solution like the LenderKit appropriateness module.