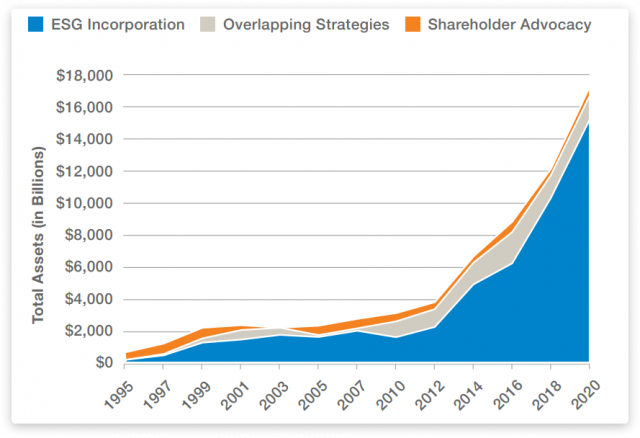

A year ago, Statista conducted research on ESG investments.

The key takeaway — sustainable investing is likely to become the leading investment focus in the future.

90% of the research respondents support environmental projects. A half is obsessed with a social aspect, 60% are gravitating more towards the governance initiatives.

Given the good cause of ESG investments, many pitfalls make these investments “not-so-sustainable” and even fraudulent.

This fact spurred authorities in many countries into developing a regulatory framework for ESG investments.

Some requirements, particularly a detailed ESG disclosure, can help combat “greenwashing” and protect sustainable, socially conscious backers.

Herein we’re reviewing the current state of ESG regulation in the UK and EU, requirements for businesses and the impact it makes on them.

What you will learn:

ESG regulations to combat the dark side of socially responsible investing

Investments based on social values, environmental impact and governmental initiatives refer to so-called “sustainable investing”. Other theorists consider it as a type of SRI (socially responsible) investing.

It’s not very important how to classify ESG investments; what really makes sense is the nature of projects these funds are generated for.

While some backers are hunting crazy yields, others think about the role of their funds in overcoming global challenges.

And the stats show that more and more angels are joining the latter squad.

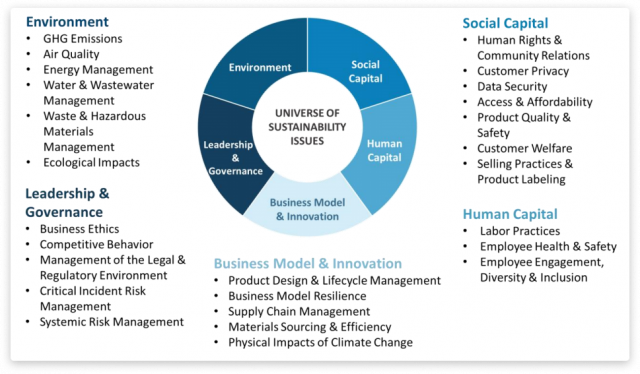

Before splurging, responsible investors weigh up ESG issues:

- environmental risks related to the way of how a business manages resources, in particular carbon footprint, and minimises the climate impact;

- social activities: health and safety promotion, human rights protection;

- governance risks related to corporate risk management, protection of shareholders, information reporting and disclosure.

Today there are no unified criteria that identify one company as an ESG compliant or sustainable and another one as non-compliant or non-sustainable. And due to this, individuals and companies may have difficulties in choosing an ESG-friendly option.

What’s more, businesses can report false data about their ESG activities, for instance, hide their carbon footprint.

Christian Morgenstern, a portfolio manager at IPM, in his interview with CNBC, said:

“People or companies can very much hide their carbon footprint by outsourcing certain parts of their production process to other companies or other jurisdictions.”

And it’s not good at all.

ESG investments are not something new.

The first considerations regarding the impact capital assets may have on the social environment appeared 70 years ago.

But up to 2016, virtually no regulations touched the sustainability aspect of individual and corporate investments.

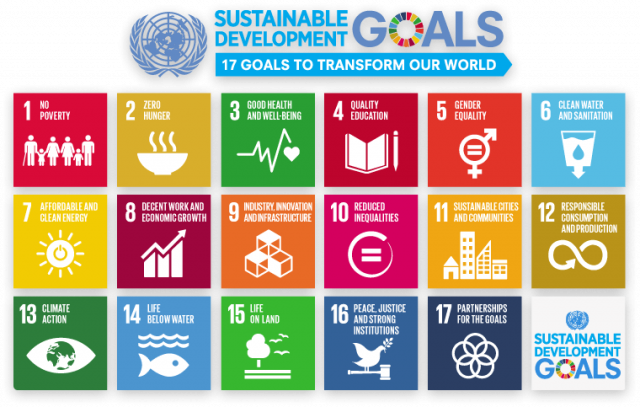

A crucial step towards the development of the ESG regulation was taken in 2016 due to Sustainable Development Goals (UN SDGs) adoption.

17 Sustainable Development Goals were adopted by the General Assembly of the United Nations in September 2015 to inform a global action plan on “people, planet and prosperity” through 2030.

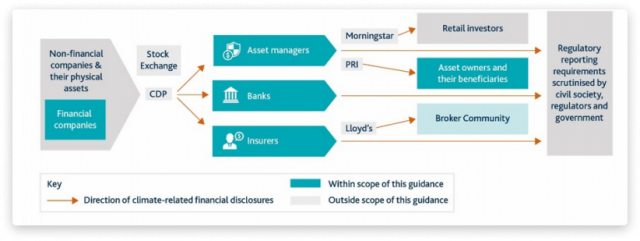

In 2017, The Financial Stability Board created the Task Force on Climate-related Financial Disclosures (TCFD), a set of guidelines to assess a company’s exposure to climate change risk.

A year later, Climate Action 100+ was established as an initiative of more than 500 investors with more than $47 trillion in AUM to engage with and assess the performance of the world’s largest greenhouse gas emitters in tackling climate change.

In 2018, The one Planet SWF Framework was adopted to accelerate efforts and integrate financial risks and opportunities related to climate change in managing large, long-term asset pools.

The EU Non-Financial Reporting Directive (NFRD) came into effect in 2018. It required listed companies and other public interest entities to disclose how they operate and how they manage social and environmental challenges.

In 2020, IOSCO issued a Report on Sustainable Finance and the Role of Securities Regulators, highlighting the challenges caused by sustainability and climate-related issues for securities regulators in their initiatives regarding investor protection, system risk elimination, etc.

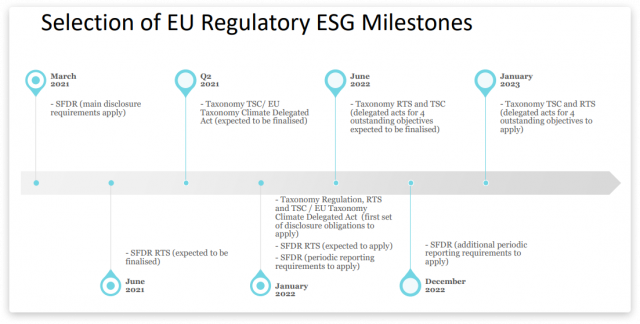

In April 2021, the European ESG Disclosure Regime came into force. The framework introduced new transparency and disclosure requirements for investment firms and asset managers on how sustainability risks and ESG factors are integrated into companies’ business processes, investment decisions, etc.

The disclosure laws are a part of the EU Sustainable Finance Disclosure Regulation (SFDR) aimed at prohibiting “greenwashing”.

- explain how sustainability risks are taken into account in the decision-making process;

- disclose the principal adverse impact of investment (pretty challenging, by the way);

- make disclosures for those products that have an ESG purpose at their core.

By obliging financial players to send disclosures at an entity and product level, authorities can achieve this goal.

US authorities face the same problem with ESG disclosures. Due to that, the SEC established the Office of Risk and Strategy within Corporation Finance. It issued several guidances on explaining how companies should conduct background research and performing filing reviews.

Sustainable and green finance regulations in the UK

The point is that the TCFD’s recommendations are not a corporate reporting standard. Consistency and comparability of corporate reporting can be achieved only by introducing a reporting standard.

FCA, the UK financial regulator, has developed its set of TCFD-aligned disclosure requirements to help companies overcome challenges in disclosing an ESG strategy.

A big surprise to all.

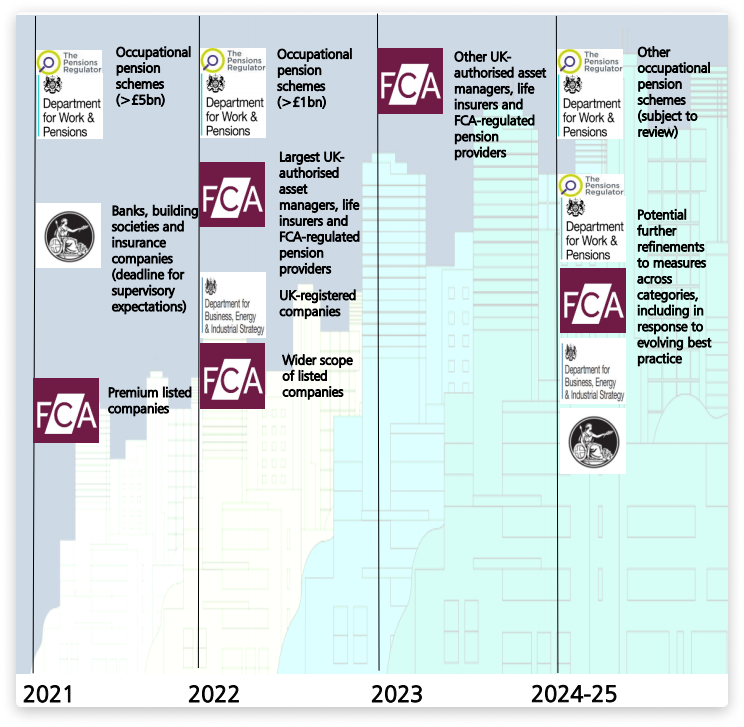

Rules were introduced in December 2020, and since then, all commercial companies with a UK premium listing must disclose, comply or explain according to the recommendations of the TCFD.

The disclosures should be included in the annual financial report.

The UK’s sustainable finance strategy and ESG legislation are based on three principles: transparency, trust, and tools.

- Transparency means the promotion of good disclosures along with the investment change.

- Trust is to ensure that sustainable finance instruments and products are aligned with investors’ sustainability preferences.

- Under tools, FCA means a collaboration of government, regulators, and industry to address climate change issues.

Also, the FCA established the Climate Financial Risk Forum (CFRF) for financial industry leaders and representatives to share their vast experience in managing climate-related risks and opportunities.

What about new SFDR requirements? Should UK companies comply with this ESG regulation and green finance laws?

Yes and no.

Legal experts say that although SFDR has not been adopted into UK law post-Brexit, UK firms may still find it relevant and vital.

You will need to comply with SFDR in case you’re:

- UK fund manager (non-EU or AIFM) who markets funds into the EU under national private placement regimes (NPPRs);

- delegated fund manager acting as a representative of an EU firm subject to SFDR;

- part of a global EU-based group considering SFDR as a worldwide standard;

- firm managing a fund with an EU structure;

- you just want to comply with SFDR because you find it right and important.

Complying with UK sustainable finance legislation: a guide for businesses

According to Rishi Sunak, Chancellor of the Exchequer, the UK has big ambitions to become the world’s pre-eminent financial centre.

Therefore, now the FCA is developing a national framework for sustainable finance regulations beyond “disclosure explanations”.

It should help the UK government achieve a net-zero target (reduction measures for greenhouse gas emissions) and other environmental objectives.

In Nov 2020, The joint Government Regulator TCFD Taskforce published the Roadmap for disclosures, many of which will come into force in a couple of years and become the main green finance rules for UK companies.

Who will undergo the UK’s TCFD-aligned disclosures?

- listed commercial companies;

- UK-registered large private companies;

- banks;

- building societies;

- insurance companies;

- UK-authorised asset managers;

- life insurers;

- FCA-regulated and occupational pension schemes.

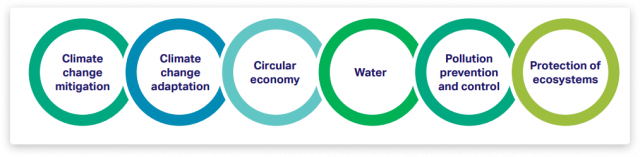

Another plan of the UK’s government is to carry out a green taxonomy — a classification system designed to outline what constitutes a sustainable activity.

The UK’s green taxonomy will be based on the EU taxonomy on sustainable activities.

Following up the US, China & a host of European nations who have already issued green bonds/green gilts, the UK will issue its first Sovereign Green Bond this summer.

This initiative will help finance projects combat climate change, get necessary financing for infrastructure, create green jobs.

How to adapt to new environmental finance regulations (from the FCA Primary Market Technical Note)?

- carefully consider ESG matters and decide what should be disclosed under the regime;

- assess climate-related risks and opportunities when making disclosures;

- make sure you have appropriate arrangements in place to support your disclosure obligations under various rules;

- if necessary, develop specific systems, analytical instruments or organisational arrangements to comply with ESG disclosures;

- always strive to make timely and accurate disclosures;

- add disclosures to your annual report or other related documents.

Why meet UK ESG regulation disclosure requirements?

- The most significant benefit for businesses is to satisfy investors’ demand regarding relevant ESG information on credit exposures and the investments they make.

- ESG disclosures will help backers effectively compare the ESG options and identify investment opportunities to increase economic reward and reduce their portfolio’s climate risk.

Consider JustCoded as your trusted sustainable finance platform development partner

JustCoded is a London-based software development company focusing on FinTech, particularly in impact investing and real estate industries.

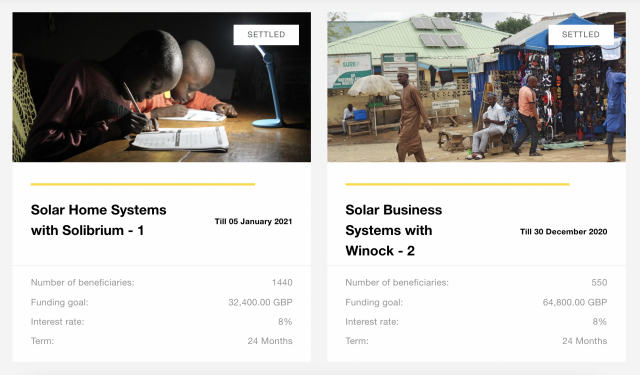

Impact investing is one of the key domains JustCoded build tech solutions for.

We have experience developing green crowdfunding platforms, integrating modern ESG investing tools (robo-advisors, climate impact scoring solutions and ESG indices), and building social investing portals.

JustCoded has an in-house white-label solution, LenderKit, enabling clients to kick-start ESG investment projects and scale them up further.

LenderKit is packed with features and customised to fit your particular regulatory framework. It’s regulations-friendly and helped many businesses from the UK, USA, and Saudi Arabia launch their projects.

Charm Impact investment campaigns Invest My School — the first UK based crowdfunding platform for independent schools seeking external financing for educational projects.

Summary

- The trend of ESG-labelled investment offerings is accelerating; socially responsible and green financial regulations keep abreast.

- Europe is the worldwide leader in sustainable investing, followed by the UK, US and Asia. The EU began developing a regulatory framework for ESG investments a few years ago. Recently the European government released the ESG Disclosure Regime to eliminate “greenwashing” and protect the rights of socially responsible investors.

- In its turn, the UK announced its sustainable finance regulatory under the FCA jurisdiction that will make disclosure requirements mandatory and unified.

- The FCA policy for ESG is aligned with the ambitious goals of the UK to become the major financial centre and leader in impact investing.