What you will learn:

The Principal Difference Between ICO and IPO

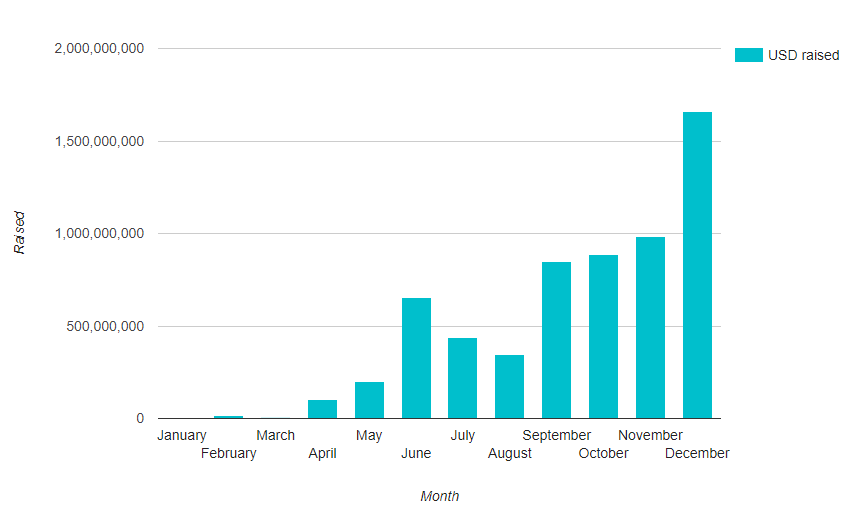

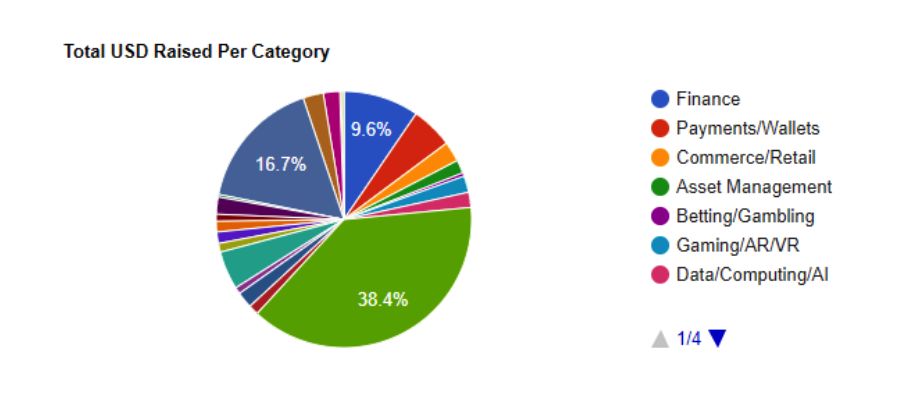

Over $1,5b was collected through Initial Coin Offerings (ICOs) in 2017 alone.

This figure is overwhelming.

The rapid growth of the cryptocurrency market has drawn the attention of both dealers willing to make a fast buck and fresh startups seeking for investments.

The opinions on ICOs have been divided.

Experts are expressing the concern about the fact that the market is still opaque and supporters considering it as a disruptive innovation which is going to significantly change the economic foundation.

The boost of blockchain has generated some terms such as “cryptocurrency, “token, “coins and others.

These terms are often associated with other buzzwords ICO and IPO, which sound very similar, yet stand for very different technologies.

Both of the fundraising means refer to crowdfunding through the generation and crowdsale of crypto coins.

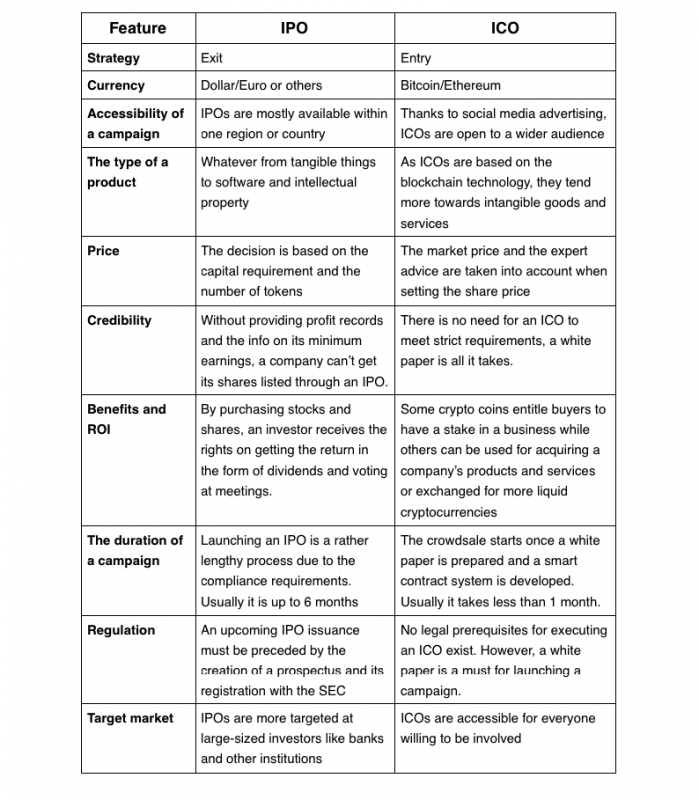

To identify the winner in the battle IPO vs ICO, let’s analyse the features of the two.

Introducing Crowdfunding and Small Companies IPOs

Nothing is impossible nowadays.

If you’re a small startup starving to be launched at minimum cost, be ready for your dreams to come true with just a wave of the magic wand of crowdfunding.

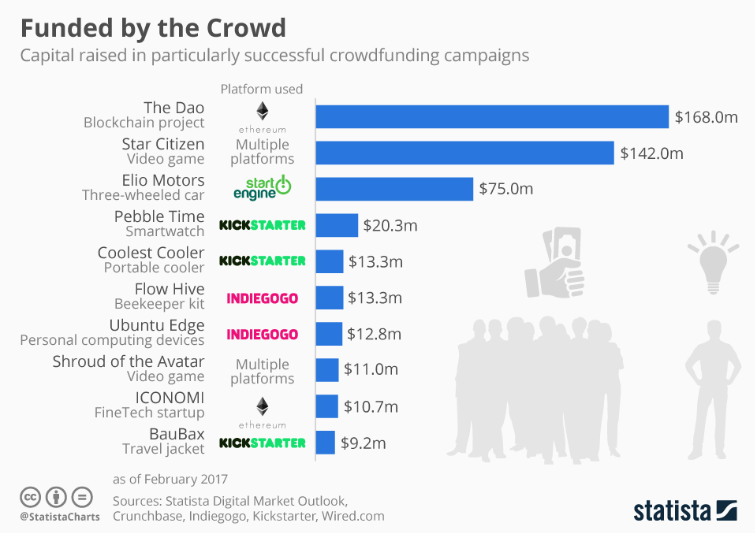

Crowdfunding campaigns run by a plethora of platforms such as Fundable, Kickstarter, RocketHub give small businesses a chance to present themselves to the crowd and fund their enterprises.

As there are no intermediaries in this process, collecting money through the public has become very popular all around the globe.

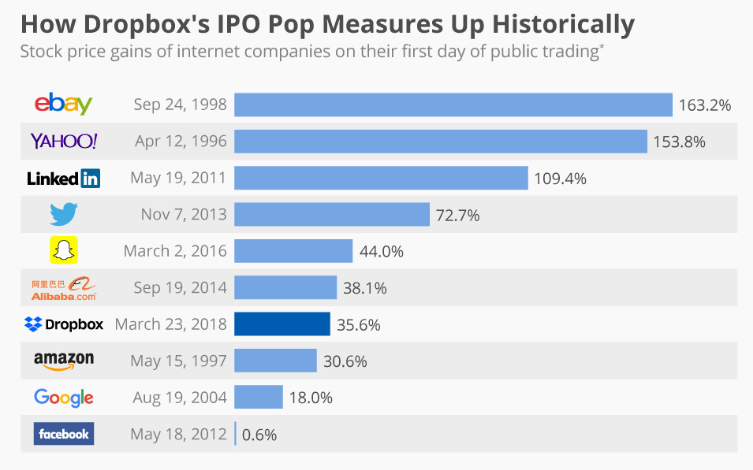

The Initial Public Offering (IPO) is a crowdfunding strategy elaborated by a private company aiming at expanding and being publicly traded.

In simple words, IPO is about selling a company’s stakes intending to raising funds for its development.

IPO concept works well for reputable companies willing to share the ownership with the public.

Investors then can use their rights which are proportional to the shares purchased by them.

The key thing about IPO is that it’s an exit campaign.

It means that a business owner or an investor may want to get rid of an asset that is not lucrative or a business which is not profitable.

Executing an IPO is a big deal and requires careful considerations.

Serious changes of the external environment, juridical reasons or personal matters may be among the reasons for closing a business.

IPO campaigns are not as simple as they seem to be.

You can’t just start selling your shares, for this purpose you will need to hire an investment bank.

Besides, any public company has to be run by a professional management team focused on the target market and that is able to prepare necessary financial documentation for the IPO process and ready to demonstrate excellent managerial skills to the board.

When all these requirements are satisfied, a company starts negotiating the terms of an IPO sale with a bank which are to be handed over to the SEC afterwards.

Only if the SEC approves a registration document, it will set the date of the public sale.

Then there comes the time of discussing the share price.

There are plenty of factors influencing an offering price such as a company’s inspirations, its roadmap and the state of the market.

Public companies are primarily targeted at big shot investors, whereas small-sized ones are not of IPOs’ interest.

However, if an individual is reluctant to purchase shares, the investment bank executing an IPO can open an account for them.

So, those people wanting to participate in an IPO have to bear in mind that the chances are quite low.

ICO – A New Step In Funding For Small Businesses

Now when everything is more or less clear with IPO, let’s get deep into ICO.

The invention of the cryptocurrency market gave rise to ICO projects.

Just like IPOs, ICO is a way of raising funds for projects on the early stage.

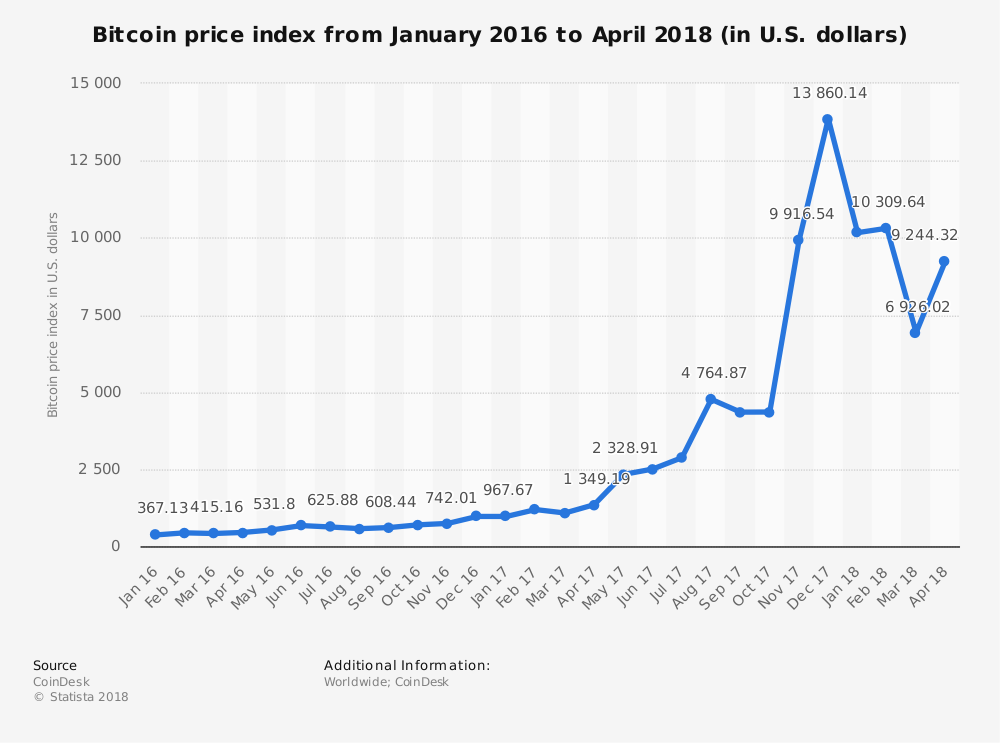

Within the framework of an ICO, tokens or crypto coins issued by a company are traded in return for liquid Bitcoin or Ethereum (check the graph of the Bitcoin price index below).

Tokens do not provide investors with equity rights and very rarely give dividends.

Being similar to IPOs, ICOs, however, are entry campaigns.

To get access to the market, startups need to raise seed capital and developing an ICO campaign may sound like a perfect solution.

Tokens price is set by companies, and it is not tied to the market conditions.

On the one hand, it is a great benefit for product owners, on the other hand, it presents a risk for sponsors as they can’t predict the probable outcome.

In case of a negative scenario when tokens are overestimated, investors are likely to be at a loss, and the worst thing is that they will hardly be able to safeguard their rights.

So, you have decided that ICO is suitable for your business and don’t know how to put it into action?

Let’s have a closer look at the whole process.

Step 1. Create a Product

First of all, you need to create a product, the one that will change the world.

Take your time and try to make your product stable and secure to convince business angels that it is worth being supported.

Step 2. Create Tokens

Surprisingly, this step has to be the easiest one.

After developing a product idea, you need to create tokens constituting a digital currency, reward points, ownership certificates, etc.

Also, you should think carefully about the amount of the main and additional tokens emission, the percentage of tokens that will be kept for your team or sold in the Pre-ICO campaign.

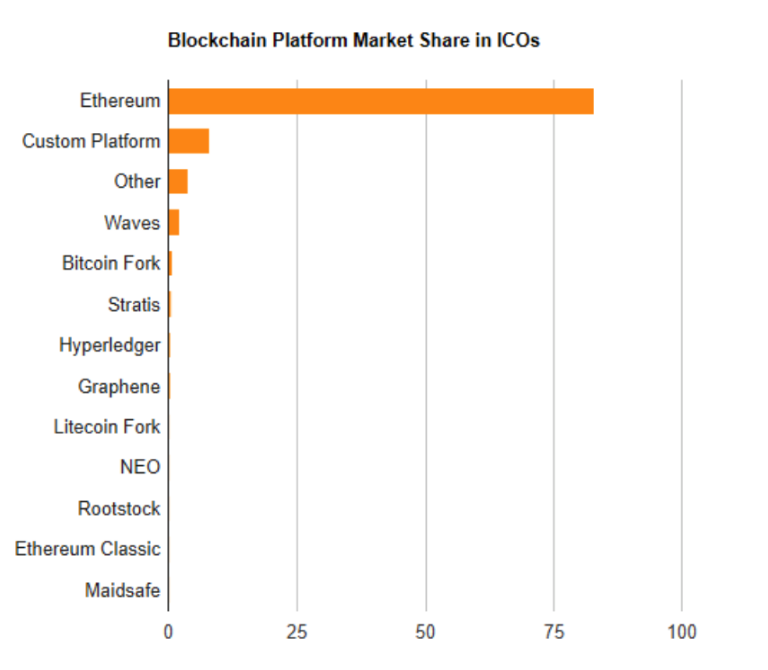

There is no need to start a blockchain yourself, there are a number of platforms that will do it for you with the help of sophisticated algorithms.

Step 3. Prepare Legal Documents

Since ICO is about dealing with money, there is a requirement to make it, to some extent, legally covered.

Though it is not mandatory, preparing the documentation that describes the validity of your token issuance plan will help you avoid possible disagreements with the SEC.

Remember, that you will need to turn to a legal advisory to guarantee the relevance of your campaign to laws and regulations.

Step 4. Create a White Paper

On this step, you will need to write a white paper, the prospectus of your ICO campaign.

The white paper should include the technical info about your product and its main features, the plan of crypto coins issuance and distribution, the members of your team, etc.

Writing a white paper is essential because it helps you to show your good intentions.

Don’t ignore recommendations concerning hiring a professional writer or a marketing specialist.

Otherwise, your white paper will be of poor quality.

Step 5. Marketing

Promoting your campaign could be the hardest thing.

If your ICO is out of sight, it will fail to attract enough attention.

The excellent idea is to use a community to hype your product through the forums, ICOs lists, Reddit and Quora news portals, Linkedin or Facebook, messengers, etc.

Besides, you can resort to paid media, something that usually works.

Step 6. Get listed.

After creating your product, writing a white paper and developing a marketing strategy, your ICO is finally ready to enter a bitcoin exchange.

Every listing website imposes unique requirements for an ICO to accomplish to be listed.

In your request to the platform, you may need to state the name of your crypto coin, its symbol and logo, the date of its launch and provide access to the reviewed open code.

Once your tokens are listed on one of the exchange websites, they can be accessed by potential investors and your ICO campaign begins.

Initial Public Offering and Initial Coin Offering regulation

The difference between IPO and ICO regulatory framework in the UK

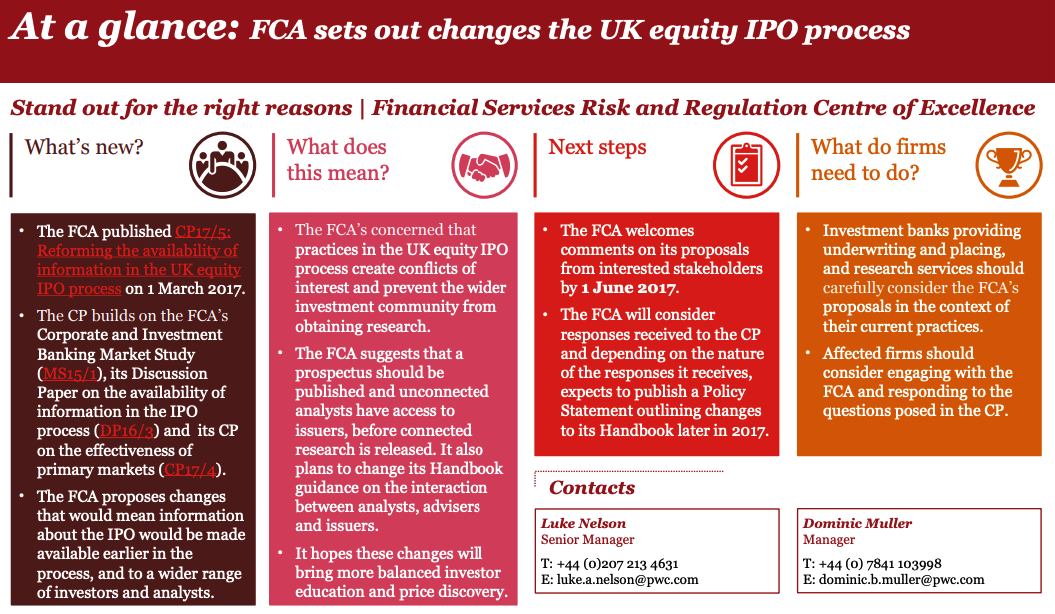

In the UK, the IPO section is an essential part of the capital markets regulated by the FCA. In 2017 the body suggested changes for the UK equity IPO process.

The main goal of improvements was to eliminate conflicts of interest between parties, provide potential backers with transparent information about fundraisers, and achieve balanced investor education and price discovery.

As for initial coin offerings, the FCA states that not all the campaigns fall under the body’s jurisdiction. Each case should be considered separately.

Despite the fact that many ICOs fall behind the FCA’s governance, some of them may involve regulated investments and activities. Each company should carefully consider the nature of the securities and activities and the need to be authorised by the FCA.

Governing initial coin offering vs initial public offering in the US

In the US, once a company decided to go public, it should file a registration statement issued by the SEC and filed in the Form-S that consists of the following requirements:

- prospectus summary;

- risks associated with the business;

- dividend policy and restrictions;

- capitalization;

- financial information;

- underwriting and distribution of securities;

- information about the company’s principal shareholders, etc.

Taking into account the increasing popularity of ICOs, the SEC has developed recommendations and warnings for all the parties involved in this process.

In particular, fundraisers should:

- use caution before promoting offers and selling coins;

- offer process and disclosure requirements to protect investors;

- report to the SEC on coin and token offerings;

- muster register digital assets and securities sold via an “exchange”.

ICO vs Crowdfunding: What Is The Best Solution?

ICO versus Crowdfunding?

The question remains open.

To clear it up, let’s move on to the detailed overview on the ICO versus IPO.

The Concept of ICO vs IPO

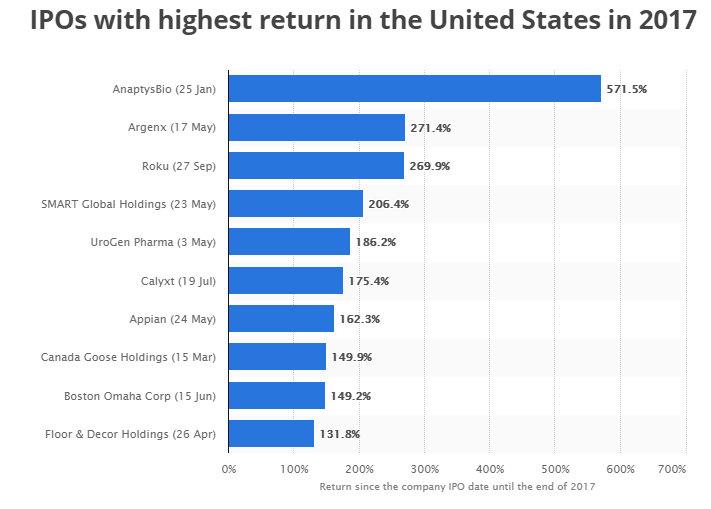

Launching an IPO is a rather lengthy process due to the compliance requirements. Usually, it is up to 6 months.

Companies raised funds via private IPOs

What is private IPO? Unlike public IPOs, where enterprises collect money of accredited and non-accredited backers, only professional investors can take part in raising capital. Investment banks and funds should meet the criteria set by the company to purchase the stake in the ownership.

We’ve got several companies who raised capital through private IPO schemes.

Frescobol Carioca

It’s a Brazilian online store selling beach clothes and swimwear. We created a website based on Magento and WordPress for the retailer using the design crafted by our creative partner Brave New World. The online store comes with numerous tech features like custom product features, Mailchimp integration and looks perfect across all the modern browsers.

Homegrown

Homegrown is one of our UK-based clients raising funds for property developers. According to Crunchbase, the total funding amount raised via 1 round of private IPO is £350K. Homegrown offers attractive annual returns on investments — 13,4% for pre-vetted real estate projects.

LuxuryBARED

The IPO model works well for all industries. One of our clients — LuxuryBARED, a top-notch travel booking and review website, also attracted angels’ funds to raise seed capital. Our task as a tech partner was to build a complex feature-rich solution that highlights the unique selling point of the company.

Shojin

Shojin, an investment company offering institutional-grade opportunities, also relied on private IPO to attract financial aid. The total funding amount was $2.3M collected through 1 funding round. The company reached out to us with a request to build a frontend for the crowdfunding platform and integrate it with Difitek back-office.

The Intern Group

Understanding the difference between IPO and ICO, The Intern Group, a global internship provider, has chosen the former scheme. As a result, the company managed to raise $40K of the seed capital. The vision of the Intern Group is to realise the global potential of the society through continuous learning and practicing.

Despite being pronounced quite seemingly, ICO and IPO are polar opposites.

What they have in common is their goal to finance business development.

Traders are more reluctant to trust IPO campaigns as they have significant legal support.

Even though there are still no legal restrictions for the ICO industry, it’s just a question of time.

The cryptocurrency market is at the top and, apparently, in 2018 it won’t slow down, quite the contrary.

We did our best to explore the similarities and differences between IPO and ICO in this article so that you’ll be able to take the right decision.

Do not consider this review as strong financial or legal advice you must follow, we just wanted it to be helpful and informative.

If we missed something or you’re anxious to add your ideas to this review, do not hesitate to contact us.