If you’re a newbie investor, you just can’t help but learn the basics of this science. It’s all a way to let your money yield tangible and intangible benefits.

Let’s start with a short quiz.

You’ve got $10,000 and three investments options.

Option #1. You may support a t-shirt vendor striving to decrease its environmental footprint. You know, clothes are so hard to recycle.

Option #2. You’re going to give money to a mutual fund that doesn’t support companies involved in tobacco and alcohol production. Smoking and drinking are “meh”.

Option #3. You’re eager to fund a startup providing renewable energy solutions to low-income households in Africa. Your money isn’t for profit only.

Now, tell us in which case you make an ESG investment, act as a socially responsible backer or make an impact?

No spoilers, the correct answer is inside the article which is to guide you around ESG vs. impact investing vs. SRI investments.

What you will learn:

What is ESG investing?

Everything new is well forgotten old. Sustainable investments have been here for almost 40 years but became extremely popular during the global lockdown.

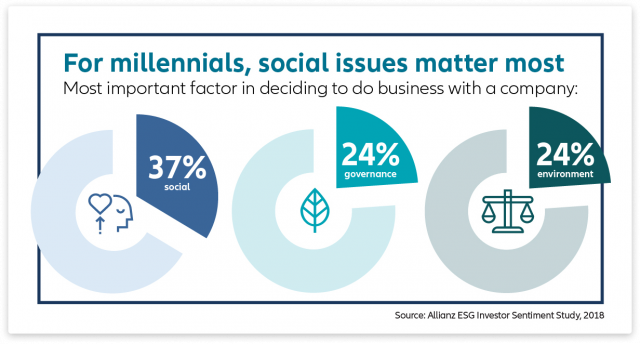

The term appeared during the 1980-90s and immediately turned into a mainstream among the Millennials fighting for people rights, environmental preservation, the health of the global community.

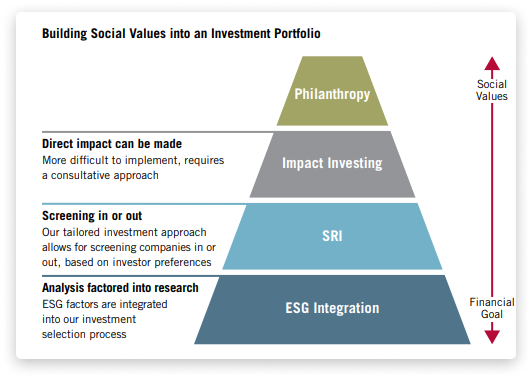

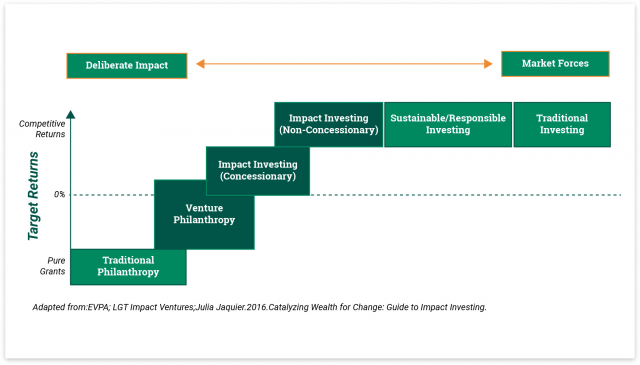

The modern sustainable investments consist of:

- development themes that demonstrate adherence to environmental, social and governance practices (ESG investments);

- socially conscious, “green” investments (SRI investing);

- values-based investments (impact investing).

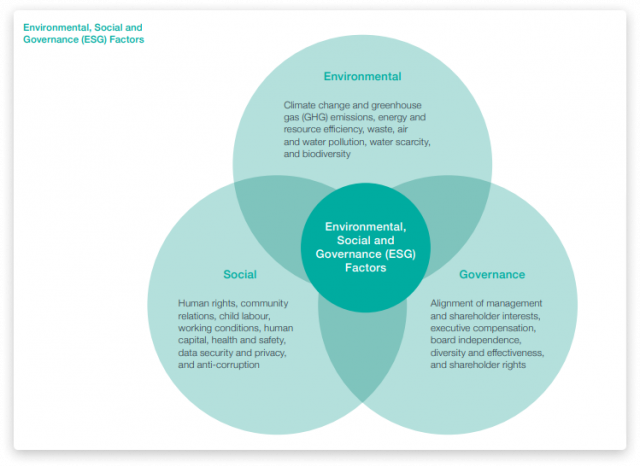

ESG investors look at the company’s environmental, social and governance practices when considering its offerings.

Companies that focus on making an active effort to either limit their negative societal impact or deliver benefits to society (or both) are most wanted.

This strategy is based on data provided by rating agencies, which grade each company on a wide range of factors related to environmental, social and corporate governance.

To make it clear how this approach works, let us provide you with an example (use case by Anthesis).

A large-cap private equity investor is considering an investment offering of a North American jewellery retailer.

The company is rapidly expanding and extending the network of its counterparts in the Asia-Pacific region and needs funding.

The screening revealed that the company had little knowledge about its suppliers in the new region. In addition, all the suppliers didn’t have appropriate certifications that prove their compliance status and the origin of raw materials.

On the other side, the screening discovered a strong corporate philanthropy program integrated into the culture of the jewellery retailer.

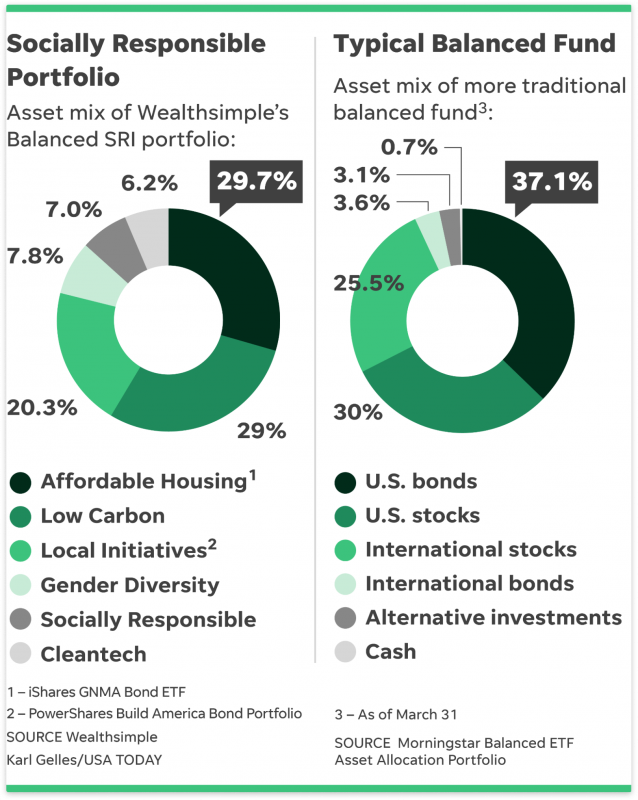

What is socially responsible investing?

Socially conscious or ethical investing pays particular attention to the investor’s socio-psychological motives, beliefs, values, objectives alongside their financial goals. Ethical portfolios are personalized and may include /exclude certain companies, niches or geo zones. Here’s an example from the Vanguard report.

The participants of the Australian fund requested to remove tobacco and weapon stocks from the portfolio’s broad international equity index exposure.

The fund analysts found out that this can decrease the underlying profile risk and make investments more socially responsible.

By optimizing the portfolio and explaining the changes in its investment policy, the fund strives to attract more socially conscious backers.

What is impact investing?

Sustainability-themed or targeted investments are often made in private equity or debt markets with the dual objective. They aim to protect and maintain our built and natural environment and get a financial return.

“Pay for Success” contracts, social impact and green bonds refer to targeted investments.

They are often specific and focused on smaller, private companies and community groups addressing certain social or environmental problems: sustainable agriculture, clean energy, conservation, housing, healthcare or education.

Values-based investments are the most challenging strategy among all types.

Here’s a case study on impact investing.

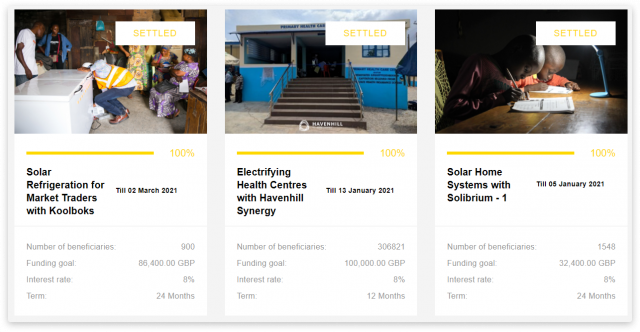

Charm Impact, one of our loyal clients, is a platform that provides peer-to-business loans to help clean energy entrepreneurs.

The company matches investors and fundraisers looking to develop clean energy solutions and combat climate change.

Charm Impact offers donation-based and debt tools to fund companies in Sub-Saharan Africa and Southeast Asia.

Focus projects: solar refrigerators and systems, electrification of households.

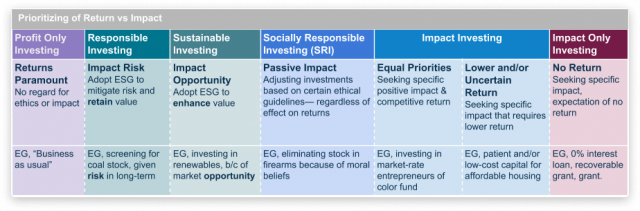

Difference between SRI, ESG and impact investing

Although three investment strategies look particularly similar, they are different by project nature, types of assets traded and balance risk-return.

The last difference between ESG and SRI investments may considerably influence the investor’s choice.

Sustainable investments are focused more on mitigating risk and retaining/enhancing value.

Ethical investments emphasize more on passive impact rather than a financial return.

Targeted investments, typically, require lower return and seek specific impact, therefore they’re riskier for backers.

The impact is more transparent and prominent in private funds, while SRI and ESG refer to publicly traded assets.

ESG vs. SRI investing vs social impact bonds trends

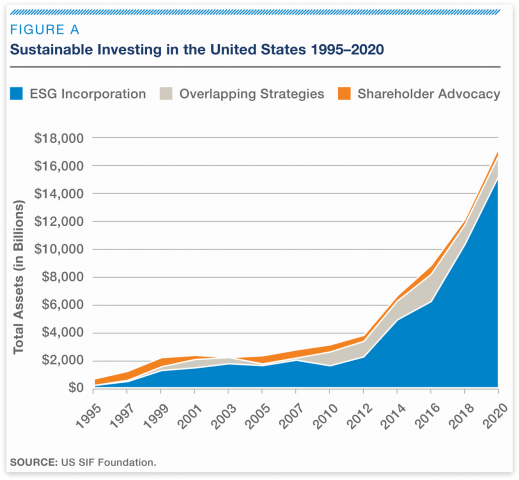

In the US alone, the volumes of sustainable investing have grown from $4 billion to $17 billion for the past decade.

Sustainable investing is a very dynamic field, and it unites a wide range of approaches. What differentiates it from other types of AUM is the consideration of risks and opportunities in the decision-making process.

A bit of stats (we at JustCoded love it and even conduct surveys):

- investors globally expect to increase the share of sustainably invested assets from 18% to 37% by 2025;

- A larger share of investors believe that COVID-19 spurred ESG issues;

- the majority of impact investments are made through private debt;

- the US and Canada are leading in terms of impact investments;

- the energy, financial services, and forestry sector are priority sectors for impact investments;

- ethical investors admit that the main reason for their making impact investments is to bring value to the global community;

- better water and wastewater infrastructure, emission-free energy, and lower carbon forms of hydrocarbon energy are the most attractive opportunities.

CNBC reports that ESG funds have more than doubled in a year. The reasons are environmental concerns caused by COVID-19 and wealth inequality.

Institutional, business and individual backers are joining the movement. For example, Amazon has recently issued its first sustainability bond.

Experts from Oxford University predict the appearance of new tools to analyse asset-level data in understanding risks related to sustainable investments.

The next year is to bring new focus areas for sustainable investments, in particular, those aligned with the UN’s Sustainable Development Goals.

Chances are that governments will play a prominent role in boosting sustainable investments globally.

Another major trend in this industry is cross-country collaboration. By creating alliances countries hope to address such issues as global climate change, inequality, financial exclusion, unemployment, etc.

What to choose – ESG vs. impact investing vs. SRI investments?

Now when you’re aware of the key difference between these approaches, it’s time to decide what works best for you.

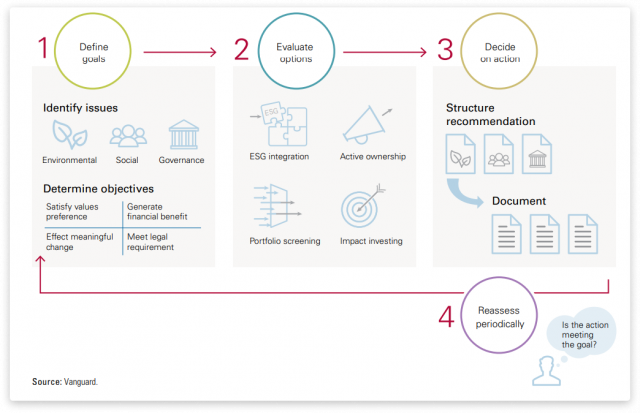

Here’s a Vanguard guide of the decision-making framework for investors:

- Define what issue or goal you’re going to address with your investment.

- Next, define ways to meet your sustainable, ethical or values-based goals, there may be several methods (ESG integration, “voice and vote” ownership, portfolio screening, impact investing).

- Decide on the action. Select important criteria and make sure that your expectations on investments made are clear.

- Periodically monitor and review your decisions.

Another great idea is to ask yourself:

- Which of my values is a priority and should be reflected in my portfolio?

- What aspect of sustainable investment (E or S or G) am I focused on?

- Do I seek more returns, want to mitigate risks or make an impact?

- Do the returns meet my expectations?

- Are my investments still aligned with my values?

Consider JustCoded as your trusted fintech software development partner

We are actively involved in overcoming global challenges. We help create financial solutions to match backers and companies building sustainable and inclusive societies.

Trending niches we cover include solar power plants, off-grid systems, local community support, wind farms, etc.

Projects we’re art and part of green crowdfunding platforms, sustainable investing solutions, impact and social investing platforms.

Using our signature software, LenderKit, we can help you launch a platform for sustainable finance, extend the scope of the existing website, migrate your off-line business to online, expand to new markets.

Portals we elevate are equipped with modern ESG investing tools, robo-advisors, climate impact scoring solutions and indices for informed investment decisions.

Hesitate what niche to choose — SRI vs. ESG — check out our customer success stories.

Final thoughts

Sustainable investing is an umbrella term for several approaches with the common paradigm — “don’t do harm”.

- The company’s sustainable development practices, the backer’s ethical values and desire to be impactful are the main factors forcing backers to be socially conscious.

- When selecting an investment offering, backers should carefully analyse their values and expectations, decide what kind of impact they want to make and carefully vet the fundraiser.

- Currently, the sustainable investing industry is gaining momentum. The global crisis and lockdown became a catalyst for the new mainstream of “portfolio greenifying”, which is here to stay for sure.