To figure out how does the Internet of Things affect banking, it’s enough to have a close-up look at how the network of the interconnected physical objects might impact any service, any business in the short run.

If the bigger picture is not clear enough, let’s get this show on the road and give you some example of IoT direct impact on the financial sector.

What you will learn:

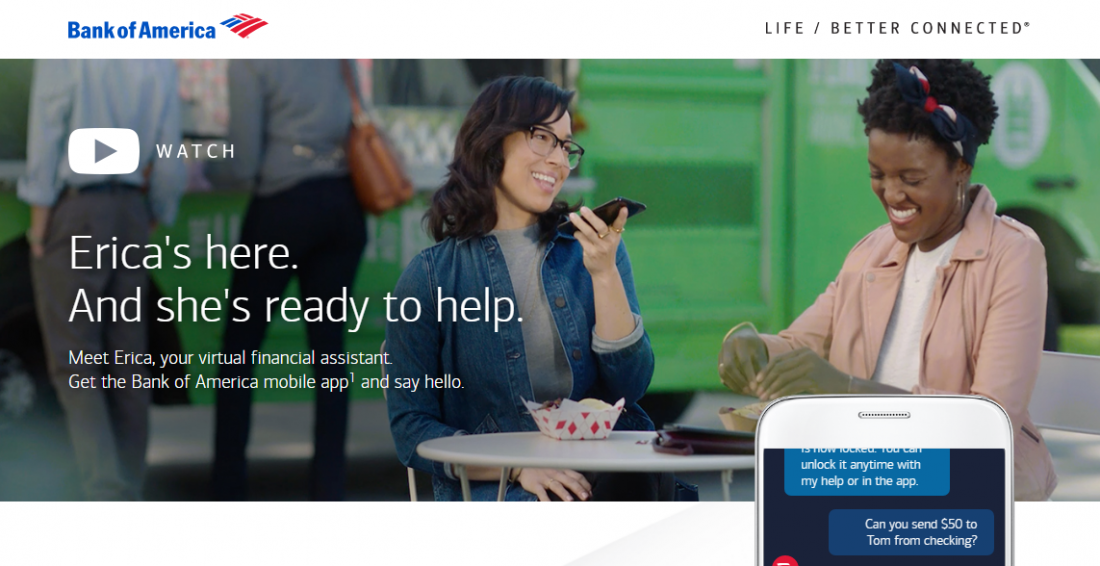

IoT in financial services: chatbots to deal with minor issues

There’re plenty of ways to enhance your CX.

However, the higher the human touch is, the more billable hours there are to pay for.

A positive impact of the IoT on the banking industry is hard to deny when it comes to timely customer assistance.

Sometimes all you need to do is to address the client’s concern quickly.

With a simple chat, customers can get a response to their queries in a blink of an eye.

One of the US’ leading banks has employed a virtual assistant to send a personalised suggestion to its clients.

Chatbots Magazine notes that nowadays banks deal with much more tech-savvy clients than they did ten years back, so a 24/7 instant chat can give a great competitive advantage to any financial player.

How will the Internet of Things affect banking from a cost reduction standpoint?

BI Intelligence predicts that chatbots will account for close to $23 billion in savings from yearly revenues.

Fraud, Internet of Things, and financial services

Cybersecurity issues have been making the headlines with hacker attacks being a top concern.

IoT in banking and FinTech-enabled risks mitigation tools are among the hottest topics in finance after the AI-powered chatbots.

You’re probably wondering where most of AI banks’ budgets go to.

Financial institutions pay for fraud detection application that can grasp a customer’s social media footprint, employment records, education etc. and to help analysts decide if a potential purchase is consistent with what customers with a similar background buy.

Here’s something really interesting: American CitiBank is among America’s top banks that pay particular attention to innovation in cybersecurity.

The financial giant has made a strategic investment in a data science company Feedzai.

And you know what?

British Standard Chartered allocates around 40% of its AI-budget to analysing tremendous amounts of data to deal with fraud risks.

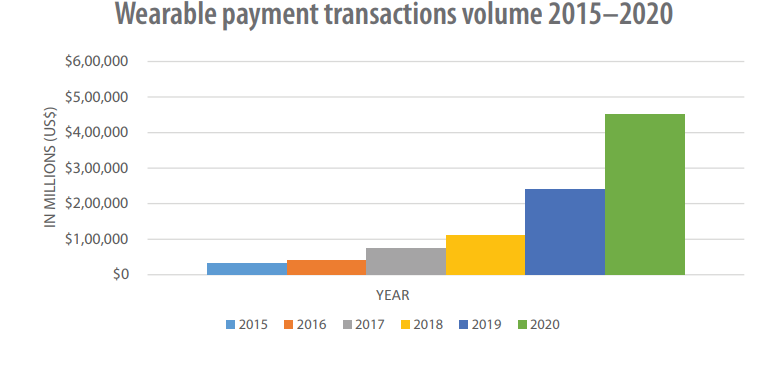

Wearable IoT and banking, the future of payments

Linked to wearables, the Internet of Things in banking industry changes the meaning of transaction and brings the way we pay for things to the whole new level.

Wearable payment popularity is to rapidly grow to reach new heights by 2020.

Willing to offer a unique experience to its clients, financial institutions might look into a few real-world examples and use cases of wearables and their effect on banking services.

When a client is near a branch office, through its wearable a bank can channel a variety of alerts: info about current promo offers and an account balance, bill payments with nearing due dates.

Furthermore, some banking professionals bank on wearables to replace mobiles and a preferred method of carrying out transactions.

It turns out that Google Wear OS adds up more and more locations beyond initial markets of Canada, U.S., U.K., Spain, and Australia; tech giant offers people around the globe to pay with smartwatches and its wallet app.

Beyond traditional currency, a trailblazer Ilmatic is to launch by the end of the year its unique wearable wallet to let the users spend their digital money along with credit card balance.

Equipped with an NFC chip, Ilmatic’s contactless wallet is another breakthrough in joining digital and physical realms.

Holistic insights through IoT in financial services

With a customer being the focus of every modern business, today’s IoT and financial services can tap into highly personalised user experiences.

Banks can mitigate risks associated with landing by getting a 360 view on a potential borrower.

Dealing with retail loans, financial institutions can assess not only a typical credit score report but, e.g. social media information, habits of eating out and driving patterns of clients to see if and when they will be able to pay off the debt.

Internet of Things and banking can work hand-in-hand when it comes to tracking consumer’s habits online and offline.

In other words, a usual questionnaire might not disclose how often a potential client is having their morning latte.

The survey might not suggest how many times per month they drop at amazon.com for yet another spontaneous purchase either.

In essence, behavioural patterns and data can give banks specific ideas about customer actions that might impact the future relationship.

Usage-based Insurance as a key use case for the Internet of Things and financial services

When IoT financial services collab comes to motor insurance, we often hear about telematics.

By definition, Insurance telematics is all about GPS technology and telecommunications among remote endpoints with further information gathering and measuring.

First off, data gets generated and further channelled through sensors embedded in-car diagnostics system and mobile applications record data automatically.

Then, insurers bring the insights under one roof. After data is aggregated, it’s easier to analyse the driving information to create custom-tailored products and services for the insured.

Black box insurance, for instance, stimulates the common sense among drivers and encourages them to be safe on the move, for example.

Taking into account acceleration, braking and cornering, an insurer can estimate the best possible price for an individual policy.

A UK-based credit broker, Money, mentions several solution providers for young drivers that harness the potential of telematics with MyFirstUK, Think Insurance, and Adrian Flux being on top of the list.

Asset monitoring with the help of IoT and banking efficiency

Further, IoT for financial services comes with multifold benefits. These perks allow any industry player to keep an eye on business operations with innovative asset tracking and management tools.

Benefits of using IoT in the banking and financial services market:

- Financial services have become more accessible and customised for bank clients;

- Financial institutions can monitor the usage of equipment such as ATMs and take decisions on expanding the network or limiting the number of kiosks;

- Big Data obtained via devices help banks identify clients’ business needs and offer win-win solutions;

- Personal records make it easier for financial institutions to provide customer support as they know the pain points of the core audience;

- Accurate data delivered by devices allow banks to make more accurate predictions in terms of interest rates and market fluctuations;

- Internet of Things in financial services enhances fraud prediction and cuts down costs on monitoring borrowers’ activity and the state of collateral.

At the same time, the application of IoT in finance industry raises a number of risks:

- The amount of data generated by devices is huge and requires banks to deploy innovative technologies such as machine learning, which is oftentimes a daunting task;

- As financial institutions have full access to clients records they must adhere to higher standards of private data protection;

- It’s vital for middlemen to take proactive measures to eliminate security risks.

Intelligent asset monitoring is about having all the necessary information at hand about different kinds of equipment which can be used as collateral, for instance, when looking for ways to finance an upcoming project or preparing for the next round of investment of a startup.

There’re many Excel killers in the space of asset tracking with some of the FinTech entrepreneurs taking up the challenge to transform the conventional approach.

Along with Vodafone that sets the trends with its valuables tracking and monitoring offerings, KloudData promises to help business owners with smarter decision-making and real-time data about the state of the assets.

Enterprise solutions provider guarantees 100% accuracy of inventory eliminating the guesswork out of value chain.

Whether you’re a mature business willing to transform your legacy operations or a startup seeking ways to put innovative technology to use, we’re always here to help.

How to deploy IoT for banking: the takeaway

According to McKinsey, there’s no universal approach to developing a financial services strategy for IoT.

Having conducted a global survey with 300 companies participating in it, they’ve found out several interesting things.

Fact #1. The most successful companies focused on their strong areas and experimented with IoT technologies on existing products.

Fact #2. A single application of IoT won’t be beneficial that’s why it’s better to scale up.

Fact #3. Implementing best IoT practices won’t result in significant changes unless you modify the business model.

Grounding on the given facts, we’d like to give you a couple of tips on how to make the most of IoT in banking and financial services market:

- Think hard on the ways of how to improve your existing products/services with the help of IoT;

- Utilise cutting-edge technologies to transform random data gathered into a valuable source of information;

- Make sure that the results of IoT deployment are understandable and convenient for your clients;

- Elaborate the strong security policy and put it at the forefront;

- Don’t stop at introducing elements of IoT in a couple of business processes, modify a global infrastructure instead.

Drop us a line and tell us your story so we can see what type of solution we can offer you. The truth is we have more stories to share about practical use cases of IoT in financial services.

Don’t hesitate to reach out if you have any further questions about the Internet of Things for financial services or financial application development.