FinTech was on a roll in 2017. With lots of funds pouring into the industry, the innovation reached new heights with half of the customers using at least one FinTech firm globally. What will find a following in 2018 and disrupt financial technology industry? Let’s find out.

What you will learn:

Booming P2P lending

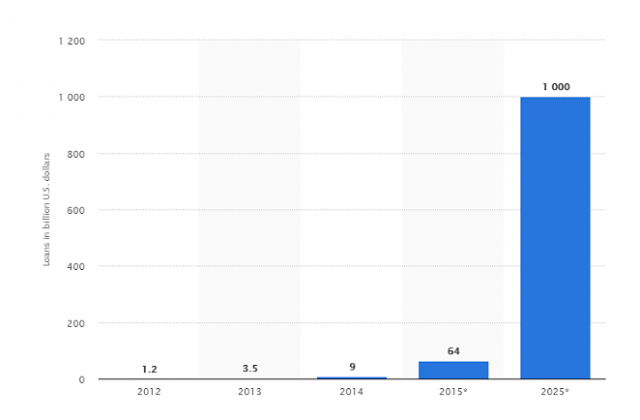

According to Statista, alternative lending transactions will account for $502,600m in 2018 with China becoming the world’s hub reaching US$427,104m by the end of the year.

Source: statista.com

We have narrowed down some popular fintech predictions 2018 to a few:

a. Faster and cheaper loans to SMEs and self-employed borrowers will become even more common offering more opportunities to scale their operations for retailers: Berlin-based Finiata is on fire having raised €18 million promising to offer freelancers, small businesses and innovative startups quick, easy and affordable invoice financing (factoring).

Let’s look at another example of Indian Lendingkart Finance that joined forces with CIBIL MarketPlace platform expanding its loan offers and serving the needs of potential MSME market.

Source: statista.com

If you take a 10-year gap between 2015 and 2025, you can estimate that the growth of P2P lending will be $93.6 billion on average yearly.

b. ICOs, a tokenised crowdfunding, become another option for trailblazers to scoop seed capita beyond the money they get from FFF.

In this segment, Singapore is making headlines. Here’s why.

TenX raised $80 million and became one of the success stories in ICO space. The company is a multi-blockchain wallet that partnered with Visa to bring digital currency to the real world allowing users to convert and spend virtual currencies anytime and anywhere.

TenX, however, was not the biggest fish that earned the trust of backers. If you check ICO statistics, the last year winner was Tezos, the company that raised $232 million comparing to 2016 largest deal of Iconomi that gathered only $10.7 million. The trend is obvious.

c. Crowdfunding will boost fractional investing in real estate market: since peer-to-peer lending earned its reputation of a reliable source of financing, many investors search for higher diversification and passive investment opportunities, so they choose fractional investing.

The last several years have seen some reputable startups innovate in this space, and 2018 might lead to individuals switching from 100% ownership to its version enabled by crowdfunding.

Machine learning, AI boom

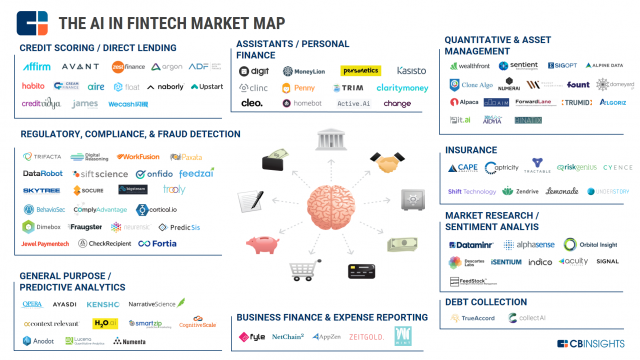

Application of artificial intelligence is not new in FinTech, but it’s going to accelerate in the coming year adding more edge to existing offerings. The industry players use AI for a number of reasons:

– fraud detection: advanced analytics champ from sunny California, Skytree utilises subtle structures in the data to provide a quicker and more accurate point of compromise;

– predictive analytics: Chicago-based Narrative Science turns raw data into intelligent insights that tell better stories and help customers make informed decisions;

– finance and expense reporting: German AI-startup Zeitgold helps small business owners with paperwork with a simple mobile app.

In the nearing future, the number of AI use cases will grow exponentially, refining existing offerings and bringing bold ideas from labs to the real world.

Check this out: CBInsights has drawn a comprehensive map of the players who contribute to overall disruption and create more room for innovation using machine learning and artificial intelligence moving those to the top fintech trends for 2018.

When it comes to the latest trends in the FinTech industry, it gets better with chatbots that will get even smarter being able to digest sophisticated inputs due to improvements in natural-language processing landscape.

Banking and financial services are likely to look further to adopt chatbots and pass on more routine tasks from employees to machines to cut down costs. And guess what? To do so, they’re likely to team up with FinTech to help them infuse more robotics to appeal to tech-savvy millennials.

Security in focus

As the line between digital and physical becomes thinner, and everything gradually moves to the cloud, keeping sensitive information safe at enterprise level becomes a greater concern.

There is a chance that a number of startups would capitalise on one of the technology trends in financial services and offer solutions not to mitigate cybercrimes and clean up the aftermath but to prevent those events from happening at all. See the difference? So the primary focus will shift to countering data breaches and cyber hacking before they occur.

Now hang on: according to Fintechnews and its fintech trends 2018, there will be a tremendous hike in using fake identities to open bank accounts, so the need for improving fraud detection capabilities and backing up digital channels for the banking sector is vital.

Such a situation is yet another opportunity for FinTech to tap into this niche offering more assurance to financing and investment segments.

Stronger ties with retail and corporate banking

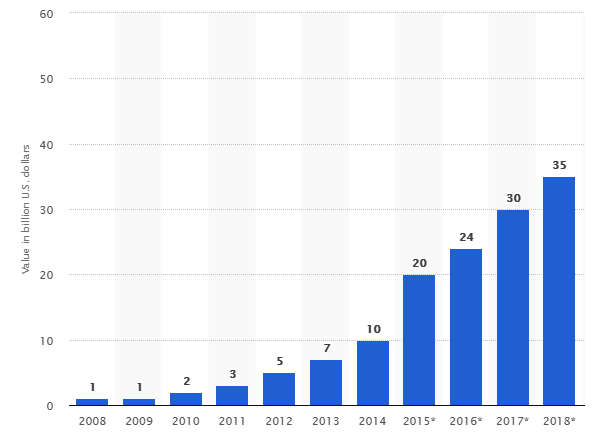

Large financial sector players will continue harnessing FinTech innovation when embracing digital transformation: they have tons of admin work to automate especially in the areas of governance, risk and compliance fronts dictated by regulators. Have a look at the global value of FinTech investments:

Source: statista.com

Among FinTech players, there is a particular niche that focuses solely on risk and threat detection, for example, called RegTech, and its goal is to fill in the gaps in compliance and reporting.

This gives the green light to emerging sub-set of FinTech, bringing more agility to banks and financial institutions. RegTech, as one of the financial technology trends to watch, embraces regulatory challenges and offers more efficient technology to deal with compliance.

Perhaps unsurprisingly, there are growing numbers of startups that are tapping into this market already. For example, Quarule supplies intelligent compliance and risk control tool and educates machines on policies, standards as well as regulations.

Broader use of blockchain

Distributed ledger technology finds more room in the sun, and it’s not only about bitcoin and its fancy status of “digital gold.

The usage of blockchain can eliminate the specific problems in trade financing and account for about 1/5 of market players adopting it in the coming 3 years. How’s that?

– To begin with, blockchain offers a much better level of transparency; thus, reducing the cost of Letters Of Credit (LC) transactions for there won’t be any necessity for a third-party verification;

– Another reason to embrace DLT is its power to reduce the time needed to settle a transaction because it cuts the middlemen. So a usual 10-day procedure will only take a few hours;

– Ethereum and smart self-executing contacts are promising, too due to elevated, full transparency. Thus, it doesn’t need any manual processing, and as a result, it streamlines the process from A to Z.

This is just a scoop of our guesses and a handful of biggest trends in FinTech you need to watch in 2018.