In 2019 the ways to gain passive income from property deals are limitless.

Old online property funding has been taking new shapes allowing both everyday and sophisticated angels to support formerly inaccessible projects.

We’re talking about the emergence of online syndicated companies such as CrowdStreet and Realty Mogul operating on a co-investing base.

Despite the fundraising method being at the core of real estate syndicates, they’ve got certain peculiarities.

Let’s see what’s better – crowdfunding or syndication?

What you will learn:

What is real estate crowdfunding?

Let’s review what you know about providing public capital for real estate.

Real estate crowdfunding is a type of alternative backing that helps commercial or industrial property developers get the necessary funds for completing their undertakings with a magic wand of the crowd.

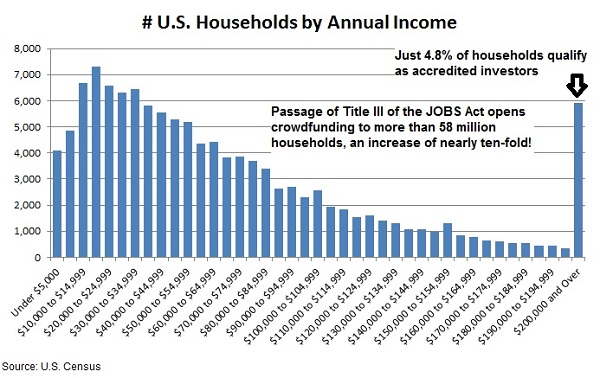

Earlier, investing in real estate was a priority of institutional angels with tons of cash in their pockets.

Delivering more appealing returns than securities, the property investing had been luring small backers until the adoption of the JOBS Act.

The law gave a “go to fundraising companies and allowed them to unlock the real estate investment market for individual sponsors.

The legal framework

Since alternative financing generates many risks for non-accredited investors, the regulatory bodies all around the globe are adapting their strategies towards its innovative forms.

In the UK it’s FCA who controls fintech companies and protects clients. It imposes specific rules for P2P lending and equity financing platforms.

Not so long ago, the regulator announced new rules for crowdlending platforms aimed at eliminating investors’ risks

A similar impact on angels’ security has the SEC, the body controlling capital and securities markets in the US.

The updated Title III of the JOBS Act allows non-accredited backers to support crowdfunding campaigns, property projects in particular.

However, there’s a restriction constraining the financial support: individual constraints depend on the amount of net worth and income generated annually.

What is a real estate syndication?

Real estate syndicates have been serving as sponsors of property endeavours for a long time.

Due to the SEC rules making investment alliances apply for picking up the cash through the public solicitation, the majority of syndicates operated as private entities.

As a rule, such private co-investing groups were created by country club members, family trusts, business partners.

With the growth of online portals for funds mobilisation, the format of real property alliances has changed.

Thanks to the JOBS Act, organised pools of investors were enabled to skip registration when reaching out to public money.

As a result, all the parties-lenders, intermediaries, and borrowers got some good out of it:

- Intermediaries involved more partners, got opportunities to boost income and partake in larger deals;

- Lenders had a chance to diversify portfolios, reduce risks, and enlisted the support of professional backers.

- Borrowers were able to get funds more quickly and efficiently.

How real estate syndication pattern works

Before diving into discussions about differences between crowdfunding and syndications, let’s see how re-investing alliances work.

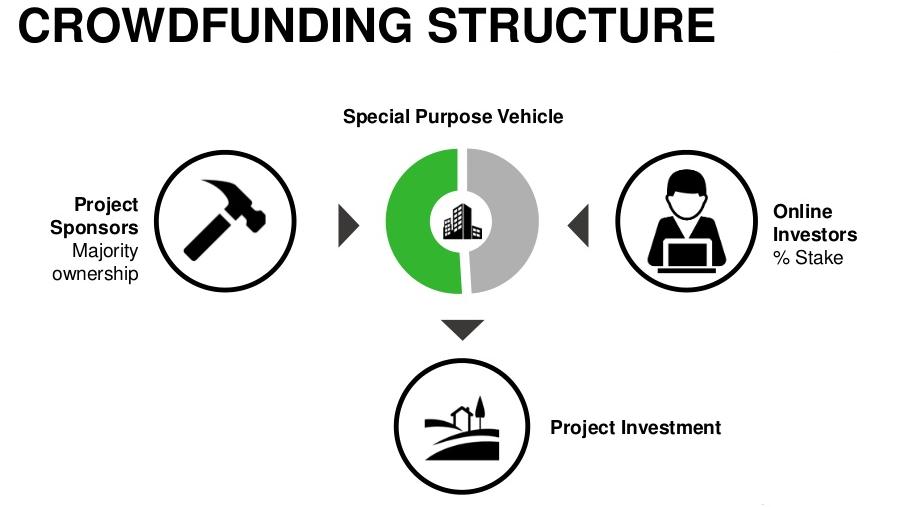

The promoter, aka a real estate crowdfunding platform, is responsible for the organisation process: it finds a property developer, analyses a project, conducts due diligence, makes and collects investments.

Typically, the syndicator’s part in the investment pool is 5-20%.

The remaining part of financing comes from external professional and everyday investors.

Real estate co-investing groups usually take a form of LLC or LP establishing the rights for all the parties: the sponsor acts as an asset manager, and backers have the role of partnering sponsors.

The positive effects of real estate syndication and crowdfunding:

- the promoter gains a small fee (5% max) for arranging a deal;

- outside backers receive preferred returns (8-12%) before the manager benefits from the cash flow;

- the manager also gets compensation (1-3%) for managing a crowdfunded property daily;

- the manager and co-investors earn money on the proceeds from equity and cash flows under the profit-split method.

Benefits of syndications for investors:

- High returns at minimal administrative and operating costs.

- A liquid tangible asset and reduced inflation risks.

- A stable passive income.

- Duties are close to zero.

Real estate syndications vs crowdfunding

As you can see, the debates on “Who wins the battle: syndications vs crowdfunding? are pointless as both models are interconnected.

However, it’s vital to see similarities and differences between the two patterns to make informed decisions. So, let’s sum up.

Nature

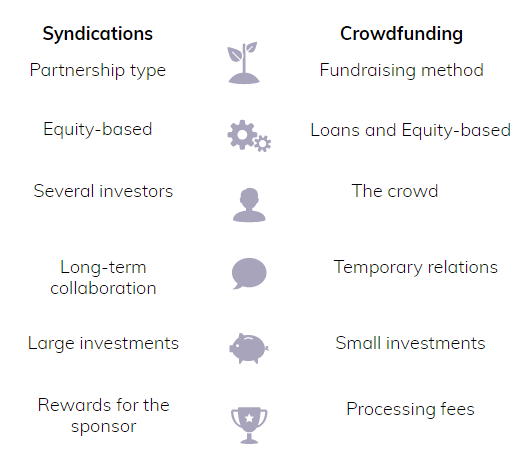

Crowdfunding is a method of picking up money, and syndications are considered as a type of cooperation between parties in investment deals.

Crowdfunding model

Crowdsourcing enterprises deal with two fundraising techniques – crowdlending and equity investing; co-investors prefer the latter pattern due to its tax benefits.

Investment size

Whereas RE syndications are in a quest for large-scale investments, crowdfunding platforms allow participating in deals with little cash.

Investors

Unlike crowdfunding portals with myriads of individual investors creating a pool, syndications consist of a few partners.

Business relations

Most of the time, communications on online platforms are neutral and temporary comparing with syndications aimed at more continued cooperation.

Fees

The fees charged by crowdfunding companies include those for signing up, raising funds and investing, processing payments.

Syndicators get a reward for a deal arrangement and management.

Real estate websites for raising funds: our experience

The JustCoded team know how to develop an online platform for estate investing.

We’ve dealt with several companies from the real estate industry and even have crafted our tool for the RE crowdfunding business.

But first things first.

CapitalRise

It’s a perfect fit for those seeking ways to invest in the luxury apartment market with potential returns of 8-12% per year.

The provider offers debt-based fundraising services for established property developers and everyday investors.

They thoroughly handpick projects conducts its due diligence and manages every deal up to its completion.

The one reason why you should choose CapitalRise is that it invests in each deal, sharing the risks with other backers.

Besides, the processing of all transactions at Shojin is free.

Shojin

We’ve elevated a website for Shojin, a famous UK-based company offering co-investing prospectives for those interested in equity deals.

Shojin functions as a real estate syndicate putting money into all the projects alongside other sponsors. Among the instruments Shojin proposes, there are rental property, loans, and mini-bonds.

Why investors choose them:

- Expected returns vary from 5-18%.

- For its managerial services, the company charges a small administration fee (2%) but splits the profit with co-investors instead.

- Shojin obtains 20% of all the profits.

- Extensive CDD reviews are one of the core features that helps the provider gain trust and attract partners.

Homegrown

If you’re looking for a fundraising platform that does business with mature property developers in the London area, go for Homegrown.

Some facts about Homegrown:

- the investment minimum is £500;

- the company offers residential and mixed-use development projects;

- there’s no joining fee;

- average annual projected returns are 13.4% p.a.;

- the company has raised funds for ten projects with £225m gross development value;

- investors can track the performance data and view updates in their personal areas;

- typically projects last for 24 months;

- the company has a profit share scheme;

- investors become stakeholders of a company they invest in, and they have a right to voting.

LenderKit

LenderKit is a crowdfunding software that simplified the development of investment portals.

If you’re contemplating the idea of starting your own real estate crowdfunding business or syndicate, LenderKit will be a perfect fit.

Technical details:

- it’s a fully hosted solution;

- it has two parts – frontend and backend;

- it has plenty of customisation options;

- a feature-rich admin area for monitoring registered users and random visitors, managing investors and borrowers, controlling finances, etc.;

- automated KYC/AML checks;

- handy CMS;

- the software can integrate with any third-party tools;

- it has a built-in secondary market;

- LenderKit comes with a responsive layout.

To bottom line

We’ve tried to shed light on real estate syndications vs crowdfunding.

As it turned out, the two notions are often misused, although they’re different.

Real estate crowdfunding is a fundraising technique, whereas joint enterprises are a type of partnership between investors.

So, if you’re a non-accredited investor choose a crowdfunding website.

If you are ready to invest your money into a large project or you’re looking for long-term cooperation, opt for a syndicate. Don’t let the crowdfunding rush sweep you away, weigh up all the options and make your choice.

Have a thought on the future of real estate syndicates? Don’t be shy, speak your mind and give us a buzz.