What do you imagine when you hear a word with the prefix “robo”?

Probably a Terminator-like machine or vacuum cleaner or, maybe, eco-friendly WALL-e if you like cartoons.

But some robots aren’t actually robots. For example, robo-advisors aren’t humanoids (he-he) well-versed in financial strategies, assets and interest rates.

They are intangible algorithms (Betterment or Wealthfront) helping you build a diversified portfolio based on your profit-risk preferences.

That’s amazing how fast the robo-advisory industry has developed since 2009 and keeps flourishing even during the COVID-19 pandemic.

In this article, we’ve gathered a lot of robo-advisor statistics, trends and future perspectives.

Scroll down to learn more about the robo financial advisors’ realm.

What you will learn:

What is a robo-advisor?

As its name suggests, a robo-advisor is an automated solution for wealth management services based on math algorithms and AI/ML technologies.

How do they work?

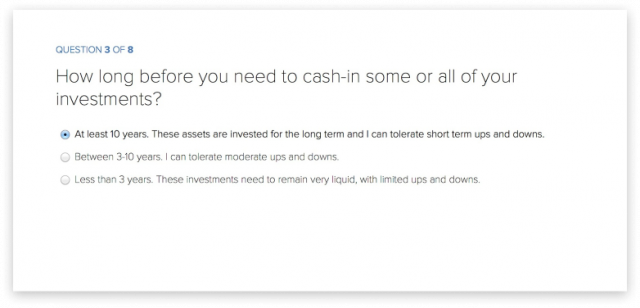

When a user signs up to a robo-advisor web or mobile app, they submit their customer data like investment goals, risk profile, time horizons, investment classes, experience, and financial situation via a questionnaire.

The system defines the SSA (strategic asset allocation) of the user and gives recommendations regarding the most appropriate investment strategy.

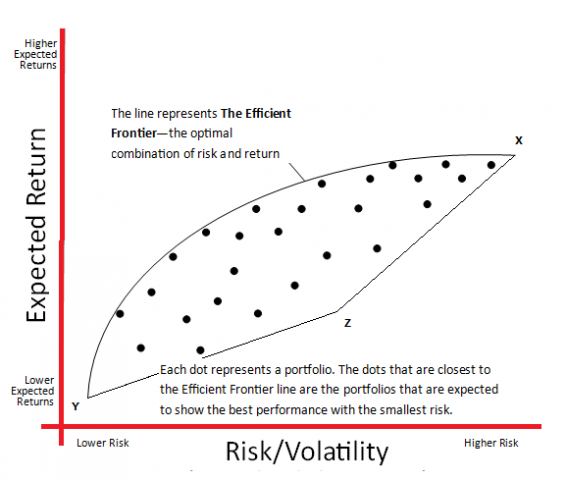

The majority of portfolio managers use a modern portfolio theory developed by the economist Harry Markowitz in 1952. According to the theory, an optimal portfolio maximises the expected return given a level of risk tolerance or minimises risk given an expected return level.

In addition to investment strategy recommendations, solutions can offer portfolio monitoring, rebalancing, diversification, retirement planning, tax-loss harvesting.

Types of robo-advisors:

- standalone solutions: Wealthfront, Betterment;

- segregated assistants;

- fully-integrated advisors: Schwab Intelligent Portfolios, Vanguard Digital Advisor;

- robo for an advisor: Betterment for Advisors.

Robo-advisor market size

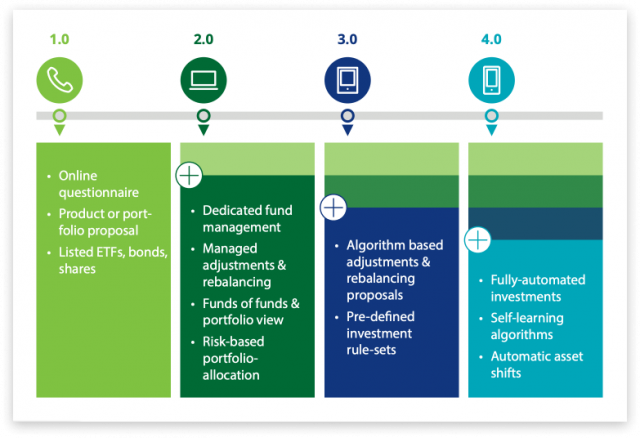

As Deloitte explains in its report on digital wealth management, the industry has passed several stages (1.0—4.0), from web-based and mobile product portfolio solutions to fully automated investment magazines with an ability to self-learn.

Digital portfolio managers stem from the FinTech industry. The first players headed by Betterment appeared in 2010, just when alternative financing was in its infancy.

To compare — in 2011, Betterment had 10k clients, in 2016 – 175k, in 2021 – 500k.

Not only Betterment’s success is crazy, but the overall performance of the industry also astonishes.

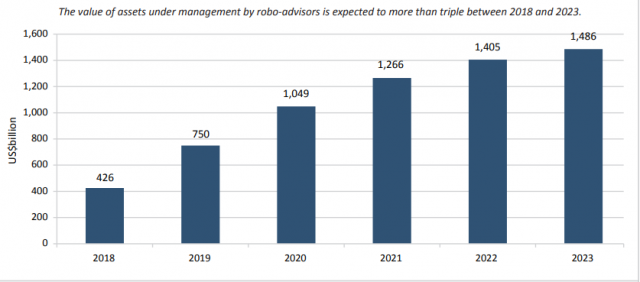

According to Statista, assets under management in the Robo-Advisors segment are projected to reach $1,4m in 2021. It’s three times higher than in 2018.

The good and the bad of robo-advisors

Every rose.., you know, has its thorns. But let’s talk about the beauty of roses robo-advisors. Why do even banks bother with launching digital advice solutions?

Benefits of robo-advisors

First off, it’s accessibility. Automated wealth managers enable clients to get financial advice and manage investments without attending the branch physically.

Administrative cost-cutting (salaries and facilities) can also be added here. Incumbents may require a fixed min amount to open an account to cover operating costs, while new solutions may not require any.

Users save on robos as well. Instead of paying for trades performing, investors are only charged for passive investing.

Another great benefit for investors is tax-harvesting. Digital advice platforms are very efficient in finding tax harvesting opportunities in the portfolio, offering substitutes and performing trading. Tax harvesting delivers nice perks for backers as asset losses decrease capital gains and reduce taxable income.

Digital advisors are more objective than human advisors. As its the people who develop algorithms, they can integrate subjective human biases during the design stages. However, robos are still more impartial.

And yes, portfolio managers are serving a previously underserved audience with lower income and less investment background.

There are few limitations of smart wealth managers:

- less personalisation due to unified approaches and standard robo-advisor technologies applied to all users;

- the necessity for developers to keep solutions updated and robust;

- apps perform well only while the market is stable, fluctuations may be a challenge;

- given that robos are trained to fulfil safe long-term strategies, dealing with risky hi-profit schemes may be hard for them;

- limited recommendations due to the lack of user information;

- personalised wealth managers are great for backers with basic needs; however, investors with sophisticated requests may find them limited;

- lack of dedicated regulation, which may entail the risk of conflicts between parties.

Robo-advisor performance statistics: facts and numbers

There are three types of lies – lies, damn lies, and statistics. But not in the case of automated investment advisors.

Numbers prove the growth of robo-advisors and their popularity.

Some interesting facts about the robo-advisor industry:

- solutions gained popularity after the 2008-2009 global financial crisis due to their safer investment scheme;

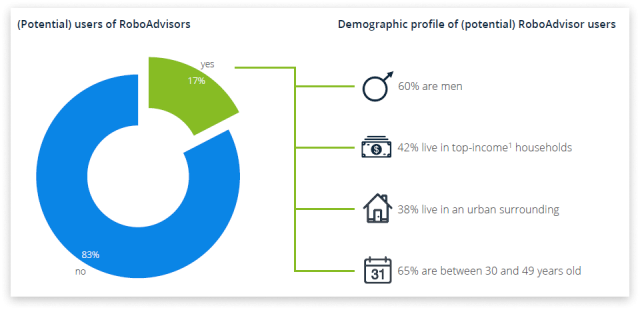

- the target audience of digital advisors is rich young men;

- potential users of robo-advisory services tend to rely on advanced financial products and services more frequently than an average American;

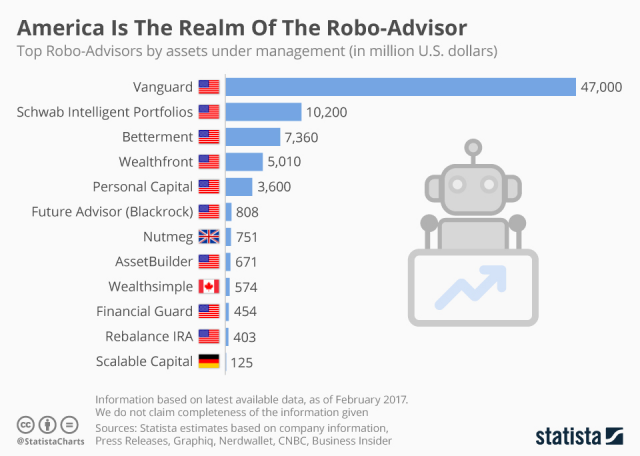

- the US is the leading provider of robo-advisory;

- according to Statista, bank clients are the fondest of robos and would like to deploy new solutions provided by their banks.

The current global crisis has revealed the sustainability and resilience of digital wealth management services. During 2019-2020, the robo-advisor market size has increased from $827b assets under management (AUM) to $987b.

The niche is set to grow in years to come and is very appealing for fintechs and incumbents.

Vanguard is the front-runner with about $129b robo-advisor market share. The top 5 digital portfolio managers manage about $199 bn, which corresponds to a market share of 40%.

The list of best robo-advisors in April 2021 according to Nerdwallet:

- Betterment,

- Wealthfront,

- Vanguard Digital Advisor,

- Stash, Ellevest,

- SoFi,

- Ally Invest Managed Portfolios,

- SigFig,

- Axos Invest.

Robo-advisor performance prognosis

By 2025, the market size is expected to rise by over $16tn, roughly three times the amount of assets managed by BlackRock, the world’s biggest asset manager to date.

At the beginning of the pandemic, the market experienced a downturn caused by investors’ unwillingness to pour available monies into unstable assets.

However, up to the end of the year, robos demonstrated positive performance records. Many new retail backers tried their hand at digital wealth management and preferred risky fractional shares of the big movers.

Robo-advisors support and encourage backers to build socially responsible investment (SRI) portfolios, which are very popular now.

Retail and professional investors tend to be more selective in the choice of projects they support; they weigh the impact their investments are to make on the global economy and humanity.

Statista reports that in Q1 2020, Betterment’s SRI-themed portfolio equalled 14.9 per cent (non-SRI — 16.8), Wealthsimple’s — 11.3 (non-SRI — 9.2).

How is the robo-advisory industry regulated?

Currently, there’s no specific framework for regulating digital wealth management advisory services.

Financial regulatory bodies in some countries adopt separate laws with requirements and rules for the emerging industry.

In 2019, the SEC adopted “Regulations Best Interest” that implies broker-dealers acting in retail customer’s best interest when giving recommendations.

Also, the body issued Examination Priorities for 2019, which is a useful guide for freshly-baked robo-advisory firms. The guide highlights key risk areas: data security, integrity, compliance, and transparency.

MiFID and MiFID II, established by the EU Commission, define suitability and appropriateness principles for digital portfolio managers. Provisions recommended for algorithmic trading in the Regulatory and Implementing Standards related to MiFID II guide players around best practices of controlling and monitoring their platforms.

The FCA states that financial advice isn’t a unique service, and firms involved in wealth management should adhere to MiFID, AML rules. FCA keeps monitoring the developments of the sector and alters the current legislative base if necessary.

But the point is that two major authorities on the robo-advisory landscape, the SEC and FCA, are strengthening the legislative base, and it may become more and more difficult for robo-advisors to attract new clients at profitable rates.

Trends to align the future of robo-advisors

There are several mainstreams shaping the future of the digital wealth management realm.

1. Hybrid robo-advisors

A new generation of solutions is actively developing. Hybrid models where managers utilize robo-advisor technologies to rebalance portfolios, allocate assets, and optimize client experience are to provide more customer-focused wealth management services.

2. Advanced features

Offering initially basic investment options (low-cost ETFs, automatic rebalancing, suitability analysis, etc), AI robo-advisors are now improving algorithms to solve more complex tasks like needs-based planning, next-best-action, and retirement income planning.

KPMG notices that now wealth managers are more into assisting clients with financial challenges related to divorce, retirement, lending, healthcare, insurance.

3. Banks entering the niche

Incumbents’ activities in digital wealth management may boost the growth of robo-advisors. Citizens Bank and Citigroup are among the banking companies allocating resources to build their robos.

There are a few reasons why banks bother engineering digital portfolio managers.

The first and the most important goal is to pitch to Millennials who are the target audience of independent solutions such as Betterment.

Another objective is long-term investment options with moderate risk for other groups of clients.

Incumbents believe that offering all investment services at one place may force regulars to stick to their bank.

4. Consolidation

Investopedia says that there’s a consolidation of the industry on two levels through mergers and takeovers. Schwab completed TD Ameritrade takeover, Morgan Stanley closed the E*TRADE deal, Personal Capital was acquired by Empower Retirement — just to name a few of the recent deals. The main goal here is to bring all the services — digital advice, lending, insurance, banking services — under one umbrella and make them more accessible for clients.

On a side note

The global FinTech movement is followed by the rise of robo-advisors.

Keen interest in this niche is driven by the benefits digital advisors offer to clients and players: a wide array of services, low fees, zero minimum investment requirements, accessibility and availability.

The industry is developing even amid the Covid-19 pandemic and traditional banks consider it as a great opportunity to attract new clients.

Recent robo-advisor trends include wealth management service portfolio extension, consolidation among players, advanced AI/ML technologies, hybrid portfolio managers with the human touch.

Consider JustCoded as your trusted fintech software development partner

JustCoded is a technology consulting and web development company building solutions for startups and established businesses in online investment, crowdfunding, real estate, travel, and other domains.

For more than 10 years, JustCoded has been serving clients from the UK and Europe helping them transform the traditional financial industry. Among our clients are Capitalrise, LuxuryShares, Invest My Community, Forus.